Ambition:

Invest for a sustainable, low carbon future in a growing, primarily emerging markets issued climate bond universe

• Climate and Environmental Action: : Focus on green bonds, but also includes sustainability-linked bonds with climate objectives and general bonds of climate action issuers with a targeted business model tackling environmental change; stringent impact scoring

• Socio-economic Distribution and Equity: Inclusion of sustainability bonds and sustainability-linked bonds with social angle next to environment; all issuers are assessed on social characteristics and each issuance is linked to the SDGs; focus on emerging markets (target 67%)

• Community Voice: Issuer might be challenged on their ESG and impact characteristics or transparency; ESG assessment includes responsible treatment of clients as well as analysis on ESG issues related to community relations

Description of the fund

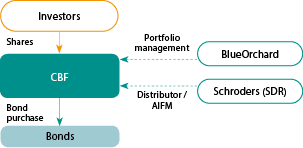

BlueOrchard’s Schroder International Selection Fund Emerging Markets Climate Bond Fund (CBF) launched in Q2 2021 with seed capital of $75 million.

The UCITS fund purchases mainly green bonds, as well as sustainability bonds, sustainability-linked bonds and general bonds aligned to climate action.

The investment process includes a stringent and independent ESG and further impact analysis; positions are only included in the portfolio upon passing both these as well as the financial assessments.

Manager

Founded in 2001, BlueOrchard has $4 billion of AUM and has invested over $8 billion over 20 years across over 90 countries.

Headquartered in Zurich with six further offices and over 120 staff globally.

Dedicated impact investment manager with largest microfinance fund worldwide and an over $550 million impact bond portfolio.

Investors

Private and institutional investors.

Key attraction points for institutional investors

BlueOrchard’s Schroder International Selection Fund Emerging Markets Climate Bond Fund (CBF) launched in Q2 2021 with seed capital of $75 million.

The UCITS fund purchases mainly green bonds, as well as sustainability bonds, sustainability-linked bonds and general bonds aligned to climate action.

The investment process includes a stringent and independent ESG and further impact analysis; positions are only included in the portfolio upon passing both these as well as the financial assessments.

Key Terms

Fund level

- Vehicle/fund type: Open-end bond fund

- Fund size: Actual size over $100 million

- Target return: Target of ICE BofA 3 month US Treasury Bill Index + 2.5% gross of fees over a 3- to 5-year period

- Management fee: 0.6% (class C) / 1.45% (class A+B)

Investee level (investment strategy)

- Instrument(s): Bonds

- Target investee type(s): Green, sustainability and sustainability-linked listed bonds and selectively general

- service offering aligned to environmental change; majority EM but also including DM; have to pass stringent internal ESG and impact selection process; current weighted BBB rating

- Target sector(s): FIs, sovereigns, utilities, real estate, materials, renewable energy, mass transit

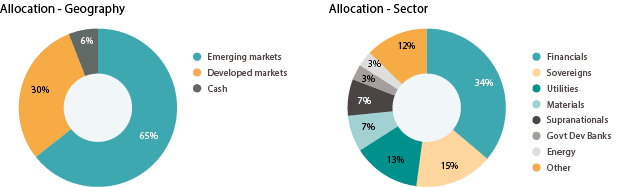

- Target geography(ies): Initially at least 50% emerging markets; exposure to increase to at least 67% after three years of fund launch

- Duration: 2-7 years, average 5.4 years

- Investment currency: Any currency, yet needs to be hedged back to USD

- bonds of issuers with a business model and/or product or

Pipeline and portfolio

Market opportunity

The Problem: Climate change is one of the key global threats; $16.8 trillion estimated investments are required for global climate finance until 2030, both in climate adaptation and climate change mitigation.

The Opportunity: $1 trillion cumulative green bond issuance since 2010 (57% CAGR); expected to increase to $2 trillion in 2023.

Just transition in the investment process

- Due diligence includes a three-step approach which includes an ESG scoring, an impact scoring and an SDG mapping (active mapping based on identified KPIs, beyond issuer claims). Prior to investment, each position requires approval from both the Portfolio Management and the Impact Management teams (independent from the Portfolio Management team)

- Monitoring includes regular review of ESG and impact assessment (at the latest within 18 months) of each position in the portfolio; ongoing monitoring on exposure to ESG issues through a respective RepRisk alert and internal analysis of cases

Structure & risks

Legal Structure

Jurisdiction: Luxembourg

Legal form: UCITS fund with daily liquidity

Capital structure: Open-end mutual fund, all share classes rank pari-passu

Key risks

| Key risks | Mitigant(s) |

|---|---|

| Geographic | Diversified: target at least 67% EM |

| Currency | Hedged |

| Interest Rate | Duration management |

| Credit | Issuer ratings, current weighted target BBB |

Outcomes framework

Climate and social metrics

Examples:

(Note: Exact metrics are currently under discussion due to rather low data availability in emerging markets.)

- Overall: Average ESG and impact scores of portfolio

- Climate and Environmental Action: Number of green/ sustainability-linked bonds in portfolio

- Socio-economic Distribution and Equity: Percentage of investments in EM

- Community Voice: N/A

- Portfolio example: Detailed insights into one position in the portfolio from an ESG and impact perspective; KPIs depending on investment intent

Framework and reporting

- Underlying reporting standards: BlueOrchard has its proprietary B.Impact framework which consists of an ESG assessment at issuer level as well as an impact assessment on issuance level. The framework is aligned with the Operating Principles of Impact Management and the IMP and classifies as an Article 9 fund according to the Sustainable Finance Disclosure Regulation (SFDR)

- Transparency: The fund reports, on a quarterly basis, its average ESG and impact scores, alignment to the SDGs as well as a concrete portfolio position; in addition, a yearly impact report will be produced (still under development)

- Third-party verification: BlueOrchard is currently in the process of getting the whole investment process externally verified as aligned with the Operating Principles for Impact Management

Select areas of Just Transition enhancement

- Could the fund expand its ambition statement to include targets for all three Elements of the Just Transition?

- Could the fund include in its assessment and potentially prioritise bonds based on the issuer’s community engagement (e.g., the verification of the relevance of products based on community need and feedback mechanisms)?

Investee in the spotlight

Investing in Greenko Group Plc

Background

Greenko is a leading renewable energy company in India.

The company develops, owns and operates energy projects with a focus on solar, wind and hydro. Net installed renewable energy capacity as of end of 2020 reached 6.2 GW across 15 states in India.

The company’s business model is focused on decarbon- isation of the Indian energy sector through digitalisation and decentralisation. As shown by the International Energy Agency, in 2020 nearly 70% of the energy demand in India still related to coal (44%) and oil (25%). Overall, the country is the third-largest global emitter of CO2 – with the power sector showing a carbon-intensity well above the global average.

Given the growing energy use in the country, companies like Greenko play an important role in improving India’s environmental footprint.

Investment

The fund invested in a March 2021 primary issuance of a Green Bond of Greenko. Use of proceeds will be allocated to expenditures related to the development and acquisition of wind and solar projects.

Impact

Based on the proprietary Impact Assessment process, BlueOrchard will track specific metrics for their impact reporting (expected after one year of issuance). KPIs related to renewable energy capacity installed as well as CO2 emissions reduced. Following the categories of the IMP, BlueOrchard sees this investment as a contribution to finance (climate) solutions and to support a company whose activity is performed in a way that contributes substantially and directly to an environmental objective.

Climate and Environmental Action: The proceeds of the Green Bond are targeted at wind and solar projects, therefore supporting building-up of such capacities in the Indian energy sector.

Socio-economic Distribution and Equity: Assessing Greenko from an ESG perspective shows high awareness of the company for social topics, and high disclosure on several aspects. For instance, they pay attention to train employees on a regular basis, not only on health and safety but also on social performance topics. Or, they maintain a customer satisfaction index for their utility customers (2019–2020 result: 100%) and report on how many contractors/suppliers have been retained beyond three years (2019–2020: 80%) as well as how many are local (2019–2020: 45.1%).

Community Voice: Greenko is setting itself concrete community development targets and goals in the area of education (interventions in government-run schools, among children and community around its operational presence), healthcare (provide quality healthcare to people living in communities around operational presence), rural development (improve living standard of people, mainly by improving basic amenities and rural infrastructure), livelihoods (providing skill training), environment (plant trees in and around group’s operational presence), impact assessment (third-party assessment of CSR interventions). For the reporting cycle 2019–2020, the company had 486 ongoing community development programmes.