We spoke to Debbie Fielder, Deputy Investment Director at the Clwyd Pension Fund to compile the information in this case study.

Fund facts

£2.3bn

Assets under Management (AUM)

June 2021

52

Employers represented

48,800

Members

10%

Funding level

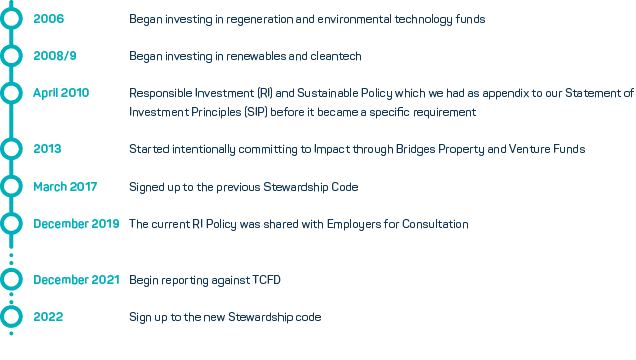

Impact journey facts

- 4% allocation to impact investments

- All 17 SDGs mapped across portfolio

- 53% of fund valued making meaningful reference to Task-force on Climate Related Financial Disclosures (TCFD)

How did you get buy in for impact investment from trustees?

The Board and the Committee viewed impact investment as a progression in the market and economy, presenting opportunities for Clywd Pension Fund. They supported the inclusion of positive impact investments: we then got our investment consultant to buy into our decision and bring us new investment ideas in this area. For us the Impact Investing Principles for Pensions represented good standard practice and acted as a concrete framework we can use to implement impact investing more broadly. We also used it to confirm that our investment consultant would comply with the Principles.

Why did you choose to use the Impact Investing Principles for Pensions?

I wanted to give my backing to the Principles as a practical framework to encourage other funds to consider impact investing. When you look at the Principles, they just make sense. Although reporting can be a challenge, it creates accountability, and we will be looking to our Consultant to assist and help fulfil these commitments.

What has your progress been on each of the Principles?

Principle 1: Set impactful objectives

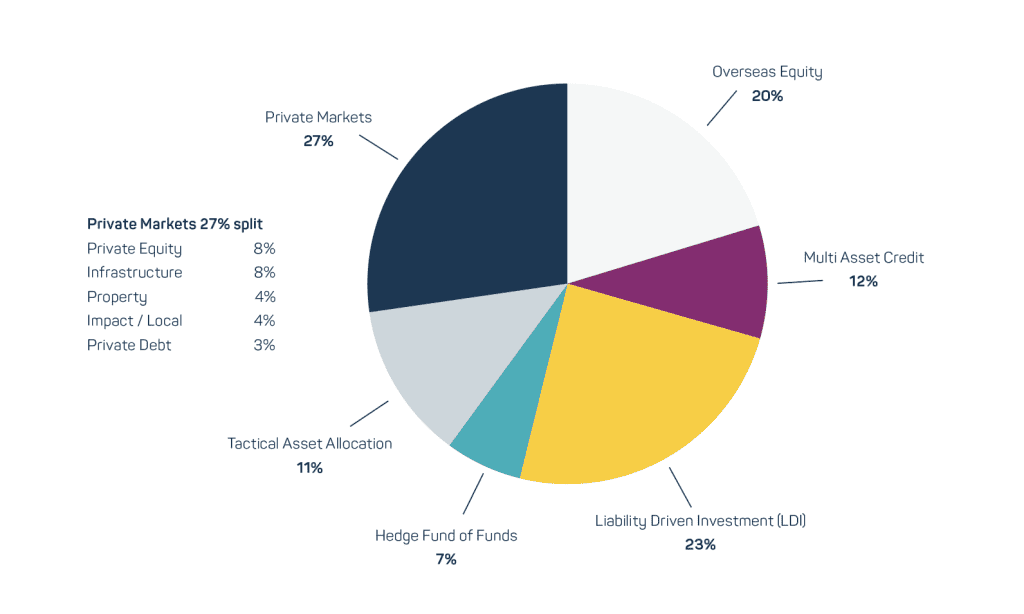

We started formally analysing our private market portfolio against the United Nations Sustainable Development Goals (SDGs) in 2017 and we identified that 30% of our private market portfolios could be mapped against a number of SDGs. The Fund has set a target of 50% for the private markets portfolio and another analysis will be made in the next 12 months. Our total commitments of £116m covers exposure to 20 investments through 12 different managers that we class as impact and where we are creating additionality. We have funds in private equity, private debt, property, renewable infrastructure and environmental technology. At the last strategy review our investment consultant did recommend a specific impact/ local allocation of 4% of the portfolio, but we also believe that mapping impact can also be extended across all of our private investments.

We are also targeting reporting against the Taskforce for Climate-related Financial Disclosures (TCFD) by end Dec 2021 and have agreed a net-zero 2050 ambition.

Principle 2: Appoint investment consultants and managers with impact integrity

Our investment consultant recommended investment in sustainable opportunities in private markets to meet our intention to move to a net-zero strategy. Our consultant uses Enviromental, Social and Governance (ESG) ratings and recommends managers with a rating of 1 or 2.

We will challenge these decisions in accordance with our objectives but we feel that the consultant has come to understand what we are looking for. Our consultant also advised on the 4% allocation to impact investment made at the last 3 yearly Investment Strategy Review. The next review will be in 2022/23. We are currently in discussions with our consultant about the allocation as we recognise it could restrict the number of investments we can make

each year, but given our priority is to Impact and Sustainable mandates we envisage that these will become the norm in the various asset classes.

Principle 3: Use your voice to make change

Through the Wales Pension Partnership, we use a specialist provider to assist us with our engagement and voting to align with our impact and ESG objectives. This will continue to evolve as we set out our updated responsible investment and climate risk policies. We were a tier one signatory to

the previous Stewardship Code and plan to sign up to the current Stewarship Code in 2022. Our current policy

states that “Engagement is the best approach to enabling the change required to address the Climate Emergency, however selective risk-based disinvestment is appropriate to facilitate the move to a low carbon economy”.

Principle 4: Manage and review your impact

We are putting a lot of this into practice but it is work in progress. For the Private Market portfolio we will concentrate on the UN SDGs we are implementing although getting the data for measurement is difficult. We have completed a climate change scenario analysis across the fund in order to identify areas of concern and are now doing a more detailed analysis of our holdings to determine the direction of travel “roadmap” to enable the Fund to achieve its ambition. We have been encouraged by our consultant to implement TCFD reporting by the end of 2021, with the carbon footprint of our managers reviewed on an annual basis thereby encouraging greater transparency.

We presented the original carbon analysis findings to the Pension Fund Committee and Board in 2020, with a planned briefing on fossil fuel exposure within the fund. We have continued, through our Consultants, to provide further education and training on responsible and impact investing through 2021 in advance of the Committee aproving the Net Zero 2050 ambition. We are still working on our SDG goals and targets, and recognise that this is an iterative process as the market and data availability continues to develop.