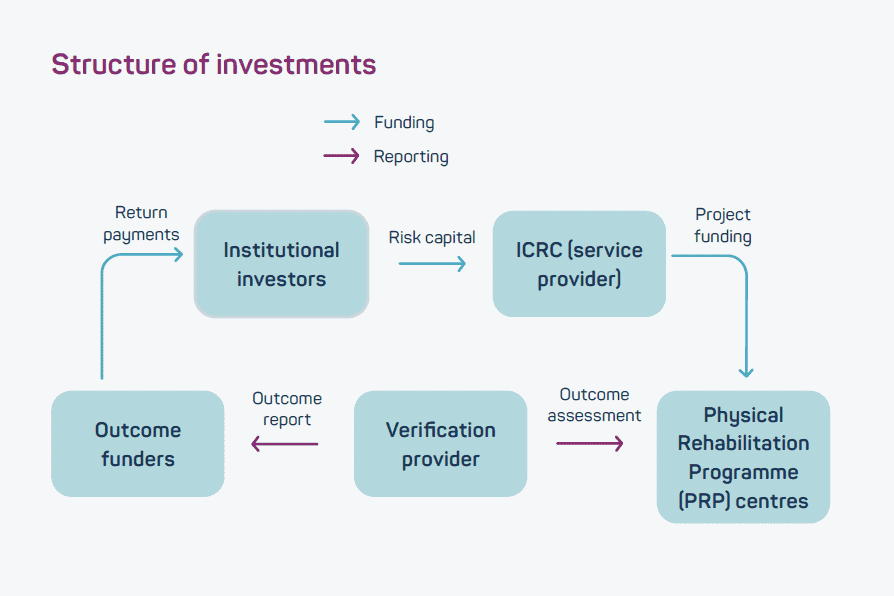

The Humanitarian Impact Bond (HIB), issued by the International Committee of the Red Cross (ICRC) with the support of the impact investing firm Kois, is a social impact bond raising private capital to finance physical rehabilitation centres and patient care for populations living in conflict zones. Risk-sharing arrangements improve the return profile for investors.

Geography: Sub-Saharan Africa

Size: CHF 26 million (raised)

Sector: Humanitarian, health

Fund manager: ICRC and Kois

ICRC is an international humanitarian organisation based in Geneva, established in 1863. ICRC manages an annual budget of around CHF 1.6 billion for humanitarian relief in armed conflicts

Kois is a Belgian impact investing firm founded in 2001 with offices in Belgium, India, the UK and France

Investment overview

| Key fund limited partners (LPs) / Investors | Munich Re Insurance (around 50%), Lombard Odier (around 50%) |

| Outcome payers | Governments of Switzerland, Belgium, Italy and the UK |

| Instrument type | Social impact bond |

| Time horizon | Five years |

Financial return profile

Returns:

- Variable (up to 7% annual), returns are scaled to the outcome metric

- Repaid at the end of the project based on project performance, including 2% annual interest

- In case of loss, 60% of capital is protected, with ICRC covering 10%

Liquidity:

- Five year fixed-term

- Repayment upon completion and verification

Risk profile

Execution risk: Risk of using a relatively untested investment model

Outcome risk: Dependent on ICRC’s ability to deliver on outcome metric

Concentration risk: Performance measured on a single indicator

Investment thesis

Performance based returns with capital protection:

Social impact bonds (SIBs) are structured to deliver competitive returns at project completion, scaled to the performance of the project

For the HIB returns could vary:

- From an annual return of 7% if the project results in an 80% or more improvement of the outcome metric, which was considered competitive by investors

- To downside risk capped at loss of 11% if there is a 100% deterioration of the outcome metric

To make the investment more attractive to investors, the HIB was structured to share risk with the outcome funder and service provider through capital protection measures:

- In case of a loss, 60% of investors’ capital is repaid, with ICRC covering 10% and outcome funders covering the remaining funds

Investment selection

Project selection

The Physical Rehabilitation Programme (PRP) was selected as the focus of the first HIB due to its funding needs and broad consensus amongst investors, outcome funders and ICRC regarding the value of the project.

The ICRC has been operating PRP centres since 1979, which meant that the project already had a strong evidence base supporting the effectiveness of the approach as well as established policies, procedures and systems.

Due diligence process

Prospective investors undertook a comprehensive risk assessment and due diligence process to assess the strengths and weaknesses of ICRC as the service delivery partner, including an assessment of ICRC’s existing eight PRP centres in Mali, Nigeria and DRC, as well as of 163 comparable ICRC centres across Africa.

A credit rating was generated for ICRC and used as a basis for the investment decision.

Impact targeting

Impact thesis

Theory of change: Through increased funding, ICRC will be able provide vital physical rehabilitation services and mobility devices to people in conflict zones

Target stakeholders: Persons with physical disabilities in Mali, Nigeria, and DRC. More than 3,600 patients will be treated during the SIB operation, and more thereafter

Impact metrics and outcomes

- The outcome metric identified captures the cost-savings achieved by the intervention and accounts for the diversity of the various PRP centres (e.g. staff numbers, patient capacity, etc.)

- The outcome metric is a Staff Efficiency Ratio (SER), calculated by the number of people who regained mobility thanks to a mobility device, divided by the number of rehabilitation staff

- A baseline SER was established from historical data from other 163 comparable ICRC centres in Africa, while a target SER was identified based on the percentage improvement between the global best performing and average centre

- An external and independent auditor (Philanthropy Advisors) will verify the results by visiting 5% of the centres and producing a verification report to be submitted to the outcome funders, which will be used to calculate the required outcome payment

Portfolio investee spotlights

Physical Rehabilitation Programme

Rehabilitation centres – Health centres

The HIB is being used to finance three new PRP centres to provide people with physical disabilities with mobility devices and physiotherapy.

The programme also trains local staff to deliver higher quality physical rehabilitation services in these centres.

More than 3,600 patients will be treated during the SIB operation, and more thereafter.

Digital Centre Management System

Health data monitoring system – Health data

The HIB will finance a Digital Centre Management System (DCMS) for all PRP centres to improve data collection, monitoring and overall operating efficiency.

The system will also improve outreach and tracking patient outcomes through new IT tools (e.g. digital tablet records, SMS follow-ups and feedback questionnaires).

NewRE (Munich RE)

NewRE, a Zurich-based subsidiary of the German re-insurance company Munich RE, provided CHF 10 million to the HIB, the majority share of risk capital

NewRE had a total of CHF 2.5 billion investments in 2019

This investment was made under Munich RE’s Principles for Responsible Investment framework alongside several other ‘impact-focused’ investments, particularly in renewables

“As a financing mechanism, the impact bond created value for us, but it also created value for the ICRC as a humanitarian organisation […] We are comfortable with the risks, given the carefully modelled probable outcomes.”

– Rebecca Cichon, Senior Structurer, Capital Partners Team, NewRe

Other similar opportunities in the market

- As of 2019, 137 SIBs have been contracted globally, with several more currently under design

- 12 SIBs have currently been contracted in developing countries, including: Colombia Workforce SIB, India Educate Girls SIB, Peru Sustainable Cocoa SIB,

- Kenya & Uganda Graduation SIB, Cameroon Cataract DIB

- In developed markets, including the UK, France, Germany and Denmark, SIBs where the government acts as the outcome payer are gaining prevalence with institutional investors, including UK local government pension funds

- In emerging markets, SIBs remain primarily financed by philanthropic organisations, including the UBS Optimus Foundation and the Children’s Investment Fund Foundation (CIFF)

Key observations for institutional investors

SIBs are starting to develop a track record

- While SIBs remain relatively new and untested instruments for institutional investors, their increasing number and promising initial results are increasing confidence in this type of instrument

- A number of SIBs have come to conclusion with positive returns for investors, including the India Educate Girls SIB, thereby starting to cement a positive track record

Risk-sharing arrangements can improve return profiles

- SIBs are inherently risky tools for investors who face possible losses of capital

- To increase their attractiveness, SIBs can be modified to provide risk- sharing mechanisms between investors, the outcome funder and the service provider

- Making the service delivery organisation “have skin in the game” by being liable for a portion of the losses incurred if outcomes are not achieved, as ICRC was, created greater incentives for high-quality delivery

Strategic partnerships can offer valuable content expertise

- The partnership between Kois and ICRC lent deep expertise to both the financial structuring of the HIB and the delivery of the project

- In a performance-based instrument, assessing the capabilities of partners is essential as returns are anchored to their ability to meet targets

- Munich RE conducted extensive due diligence on ICRC’s previous work on PRP and its centres, developing a ‘credit rating’ for the organisation to verify their risk level

Sources:

Sources: i) DFID, “ICRC Humanitarian Impact Bond for Physical Rehabilitation”, 2019. ii) New Re Impact Investing ““Everything I do is new”, 2017. iii) Brookings Global Impact Bond Database, 2019. iv) The Economist, “A new bond taps private money for aid projects in war zones”, 7/09/2017.