The IHS Fund II (SA and SSA) are two private equity funds launched by International Housing Solutions (IHS). IHS invests in affordable housing and green housing development projects in South Africa (IHS Fund II SA) and Botswana, Namibia and other countries in Sub-Saharan Africa (IHS Fund II SSA).

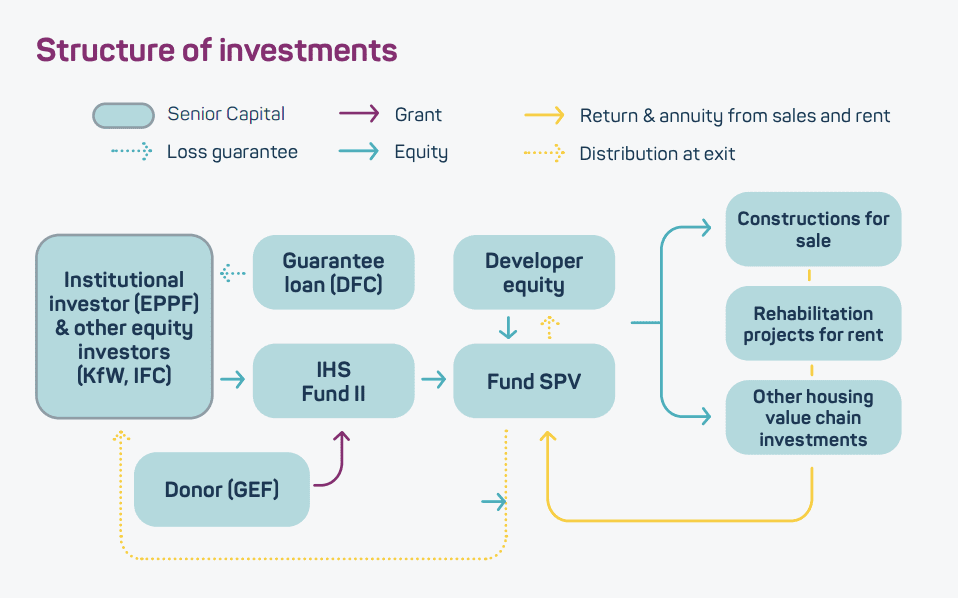

Investments are de-risked through diversified investment sources, a requirement for developer equity and use of a Special Purpose Vehicle (SPV).

Geography: Sub-Saharan Africa

Size: USD 200 million (raised)

Impact thesis: Affordable housing access

Fund manager: International Housing Solutions

Total assets under management (AUM): Around USD 500 million

IHS is a real estate fund manager established in 2006 in South Africa, which is affiliated with Hunt Companies, Inc., a large investor in real estate and infrastructure based in Texas. IHS specialises in investment in and management of affordable housing communities across Sub-Saharan Africa. IHS partners with experienced housing developers on the projects.

Investment overview

| Key fund limited partners (LPs) / Investors | Eskom Pension and Provident Fund (EPPF) |

| Instrument type | Real assets equity |

| Portfolio investment size | Around USD 1 million minimum size for portfolio investments |

| Time horizon | 5-7 year terms |

Financial return profile

Returns: Market-rate

- Target 20% per annum internal rate of return (IRR) (Currency: South African rand, ZAR)

Track record:

- Fund I achieved 23.3% weighted average IRR based on all exited deals

Liquidity: 5 – 7 year terms

- Exit at project completion through direct sale or bulk sale for rental revenues

- Purchase dates set in advance

Risk profile

Currency risk: Pension and fund operate in the same currency (ZAR), future fixed price contracts on housing prevent inflation risk

Execution risk: Multiple development partners and close due diligence

Political risk: Close alignment with government special planning committees in South Africa and countries in Sub-Saharan Africa on housing requirements and regulations

Investment thesis

A number of steps are taken to de-risk this investment:

- Different investment sources: Equity investment from development finance institutions (DFIs) with lower return expectations (including KfW, the German development bank, and the International Finance Corporation, IFC) and grant capital from the Global Environment Facility (GEF) secure higher returns for institutional investors

- Guarantee loan: A USD 80 million loan guarantee provided by the US Development Finance Corporation (DFC) protects against losses occurred

- Developer equity: Developers typically provide 70% equity on specific projects, incentivising timely and quality delivery

- Use of a Special Purpose Vehicle (SPV): Allows returns and annuity from sales and rent and re-investment in project costs until exit

Investment selection

Eligible investments

Low-cost housing developments, including single- family homes, multi-family properties and student housing. Criteria include:

- Affordability – Selling price per single unit: USD 40,000 max.

- Green credentials – Housing projects must be certified to meet IFC’s Excellence in Design for Greater Efficiencies (EDGE) standards, achieving at least 20% savings on energy, water and building materials

Due diligence approach

- Developer partner capacity: Evaluation on track record, financial and material capabilities to complete the project and operational efficiency, underwritten by strict legal agreements on timelines and milestones

- City planning considerations: Evaluation of the soundness of each project linked to city planning considerations (for example population densities, liveable environments, travel corridors)

- Market demand: Residential housing demand in chosen area, based on median local income, housing affordability, percentage of households renting vs. ownership

Impact targeting

Impact thesis

Theory of change: IHS aims to bridge the “housing gap” between government-issued housing and the private real estate market, providing low-cost solutions to individuals transitioning between the two, or who would be otherwise unable to qualify for government-funded housing. Schools, community gardens, play areas, business areas and industrial sites are also included.

Target stakeholders: Households with an income between ZAR 3,500 and ZAR 18,000 per month (around USD 200 – USD 1000) who are unable to access government housing schemes

Impact metrics and outcomes

Impact metrics defined by an independent study by the University of Cape Town (Fund I):

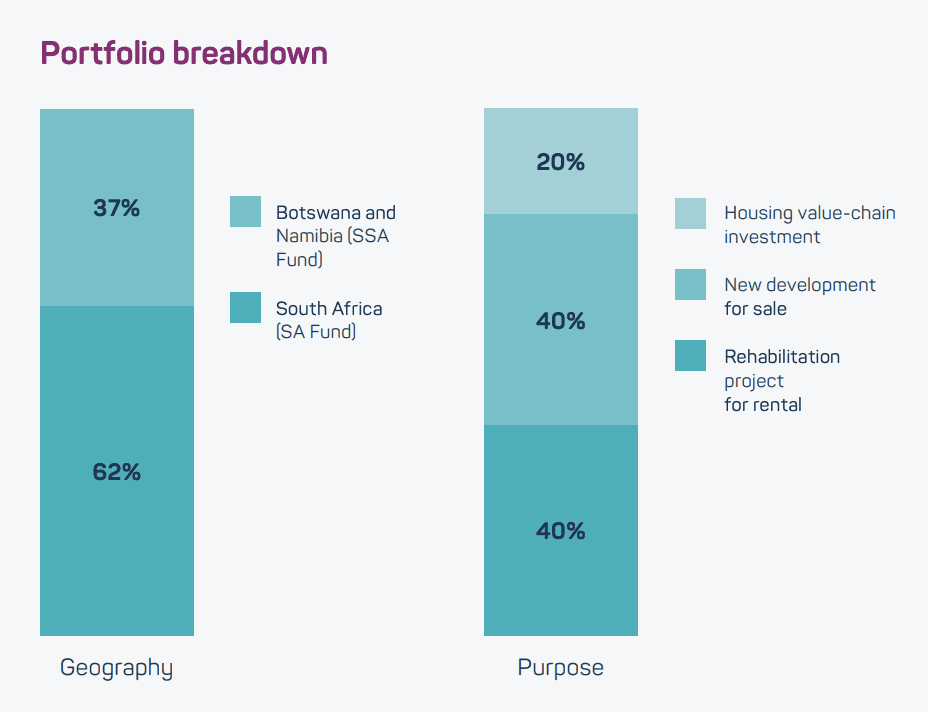

- Access to affordable housing: 28,000 new affordable houses put on the market. Fund II is expected to finance approximately 20,000 units in South Africa and 20,000 across Sub-Saharan Africa

- Job creation: 4,000 new jobs were created in the local communities, reaching ‘disadvantaged’ individuals (85%) and women (10%), the majority of jobs were expected to be retained at the end of construction and development

- Economic growth: 84% of funds were invested in low-income areas, leading to further public sector capital unlocked through co-financing, subsidies and guarantees

IHS implements the IFC’s Environmental and Social Performance Standards in its assessments.

Portfolio investee spotlights

Fleurhof project

Gas power station – Energy generation

The Fleurhof project is a residential real estate development in the Soweto Township near Johannesburg, including 8,000 low to middle- income houses, eight nurseries, five schools, 14 business centres and four industrial sites. Prior to these investments, the township lacked basic infrastructure and quality housing as one of the poorest areas in the country

Joint venture project between IHS and real estate developer Calgro M3 with listed development companies specialising in residential construction who oversaw the project

The project was capitalised with an initial equity investment of USD 16 million and over time re-invested over USD 280 million from early completions on subsequent phases

The project sold 2,818 units to government for heavily subsidised housing and 3,000 units to other social housing institutions, the remainder was sold directly to buyers

The project employed 1,000 workers, including 90% unskilled workers from disadvantaged backgrounds

Institutional investor spotlight: Eskom Pension and Provident Fund (EPPF)

Investment: Around USD 6 million

EPPF is one of the largest pension funds by asset value in South Africa, with USD 10 billion of assets under management. Their ZAR 100 million (around USD 6

million) investment in IHS is the largest investment in their Development Impact (DI) portfolio, which focuses on investments in affordable housing, renewable energy, social infrastructure, and small- and medium-sized enterprises (SMEs).

“EPPF will be making a positive socio-economic impact on thousands of South African lives by helping to create property investments for families, creating new communities and jobs, while also creating returns for its members, pensioners and beneficiaries”

– EPPF press release

“We are proud to partner in this endeavor with IHS, which has a proven track record of enabling the building of quality communities while maintaining the highest level of oversight and financial due diligence.”

– Sibusiso Luthuli, CEO of EPPF

Other similar opportunities in the market

- Private international investment in African real estate including housing is growing: the size of housing financing in South Africa, the largest market in the region, is estimated at around USD 2.2 billion

- Investment in housing and housing financing in Sub-Saharan Africa is concentrated in market-rate loans or lines of credit (70%), with only 23% of opportunities in equity

- Several DFIs and investors have made investments in affordable mortgage providers as another vehicle to support affordable housing (e.g. Kuyasa Fund, SA Home Loans, Real People, Housing Investment Partners)

Key observations for institutional investors

Investments in real assets provide an inflation hedge and help drive diversification in emerging market exposure

- Long-term investments in real assets such as housing or infrastructure can help provide inflation hedges in countries with volatile currencies, as the value of the asset remains constant during fluctuations

- Real assets also have lower correlation with the value of other market-assets and therefore can help to diversify portfolios

Investing alongside local pension funds unlocks local knowledge

- International institutional investors can benefit from investing alongside local pension funds who can provide context on local markets and key local impact priorities

Private equity can mobilise large sums of working capital

- With an initial capitalisation of USD 16 million, the Fleurhof project mobilised an additional USD 280 million from early completions to be reinvested into subsequent project phases

- Early returns were held in a special purpose vehicle until the completion of the project

- Institutional investment also mobilised co-investment from developer partners who might be unable to cover the costs directly

Housing provides opportunities for attractive returns

- IHS Fund I achieved 23% IRR from all its exited deals through a mix of sales and income from rental

- The fund secured future fixed price contracts with local government and housing associations during construction phases, guaranteeing exits before the construction phase was completed

Sources:

Sources: i) Center for Affordable Housing Finance in Africa, “Housing Investment Landscapes”, 2019.

ii) EPPF Website [Accessed 06/10/20]