Ambition:

Invest in the acquisition and delivery of affordable and green affordable housing in South Africa for rental and sale.

• Climate and Environmental Action: Deliver a minimum of 5,760 green units

• Socio-economic Distribution and Equity: Through delivery of the housing, create employment opportunities as well as deliver housing to the affordable market where there is a significant under-supply

• Community Voice: As part of the delivery of social housing units (where the government provides a subsidy), develop social integration platforms for the lower end of the housing market

Description of the fund

IHS Fund II SA (FII) invests in the acquisition and development of affordable residential real estate in South Africa targeted primarily at lower- and middle-income households with an average market value per unit of less than ZAR650,000 (adjusted by consumer price index from January 15)

Over 5,700 units are IFC EDGE certified, ensuring green housing.

Manager

Founded in 2005, based in Johannesburg, South Africa, the manager has over 40 employees.

Total capital raised is currently at $665 million, across six funds.

Investors

Combination of 10 LPs including DFIs, development banks, impact investors, pension funds and other Institutional Investors – both local and international.

Key attraction points for institutional investors

- Combined social and environmental impact investment

- Affordable housing investment in an under-supplied market

Key challenges for institutional investors

- Introduction to African market and associated risks

- Forex implications for foreign investors since fund is local currency denominated.

Key Terms

Fund level

- Vehicle/fund type: Closed-end private real estate fund

- Fund size: Actual $176.5 million

- Blending and/or TA: N/A

- Sponsor/anchor: N/A

- Term/investment period: 10 years / 4 years

- Target return: Target 20-22% gross IRR

- Management fee/incentive fee: 2% / carried interest

- Vintage (first close): 2014

- Co-investment rights: Not applicable

Investee level (investment strategy)

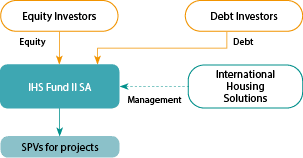

- Instrument(s): Debt (max 75%) and equity

- Target investee type(s): Real estate development held in special purpose vehicles (SPVs)

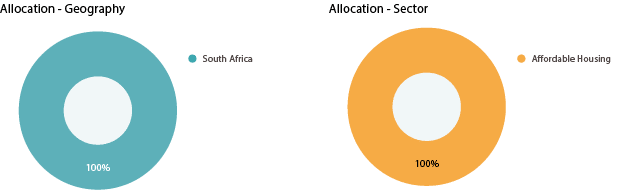

- Target sector(s): Affordable housing real estate

- Target geography(ies): South Africa

- Investment tenor: Exit all investments before mid-2024

- Average ticket size: ZAR60 million

- Investment currency: ZAR

Pipeline and portfolio

Market opportunity

The Problem: Shortage of housing affordable to the lower- and middle-income households in South Africa (“missing middle”); approximately 2.1 million houses needed to be built to clear the backlog exacerbated by rapid urbanisation according to statistics reported by the government in 2016.

The Opportunity: Supply of affordable housing.

Pipeline: Not applicable, as the fund is fully committed, 31 investments.

Allocation

Just Transition in the investment process

- Sourcing affordable housing opportunity located in infill sites close to amenities, transport and job opportunities where there is a shortage of housing

- Quarterly reporting of employment figures at investee and manager level as well as monitoring performance of green units in terms of water and electricity consumption

Structure and risks

Legal Structure

Jurisdiction: South Africa

Legal form: En commandite limited partnership

Capital structure: Single capital layer (equity) and debt

Key risks

| Key risks | Mitigant(s) |

|---|---|

| Geographic | All South Africa |

| Currency | Denominated and operated in ZAR |

| Counterparty | Strong in-house legal team overseeing the rollout of legal agreements and contracts. Deep experience, average of over 25 years of experience within the team. |

| Concentration | While all in South Africa, investments are spread throughout the country with a focus in primary nodes with employment opportunities. Market studies form part of deal approval process. |

| Credit | Max LTV of 75% at investee-level and 70% at fund level. |

Outcomes framework

Climate and social metrics

Examples:

- Climate and Environmental Action: Portfolio: green units delivered. Investee/Asset: performance of green units savings in terms of water and electricity consumption

- Socio-economic Distribution and Equity: Employment figures at both portfolio and investee level, including within IHS, the developer for the construction period and throughout operations for property management

- Community Voice: In certain housing investments, community meetings for social integration. However, not reported nor required to be reported on as a metric.

Framework and reporting

- Underlying reporting standards: IFC EDGE Certification tool for greening of units at the Investee (project) level

- Reporting: In line with requirements of both the IFC Annual Data Collection for Development Outcomes and EIB Annual KPI Data Collection

- Transparency: Annual and quarterly investors reporting including questionnaires and surveys

- Third-party verification: Green Building Council of SA for verification of EDGE certified units

Select areas of Just Transition enhancement

- Could the fund expand its ambition statement to include targets for all three Just Transition Elements?

- Could the fund include explicit prioritisation and reporting on community engagement and neighbourhood voice to ensure units are built and run to the satisfaction of the targeted population and build learnings (potentially from renewals data as well as through formalised mechanisms for consultation and feedback)?

Investee in the spotlight

Investing in Tirong development

Background

IHS identified an affordable housing gap within the node in which Tirong is being developed. While there was existing housing supply in the node, there was a shortage of affordable housing which prompted IHS Fund II SA to invest in the delivery of units that were between 3% to 9% cheaper than the closest comparable housing.

The project is located in Tirong (formerly known as Houtkoppen), located within close proximity to the Northgate Dome and Cosmo City, which was one of the largest government housing projects in Johannesburg.

The deal was closed into the fund in October 2016 and is structured as a ‘For Sale’ development deal where 638 units will be sold to the open bonded market and delivered over six phases.

Investment

Investment of ZAR33.8 million in equity into the development of 638 green affordable housing units (free-standing homes).

Impact

Climate and Environmental Action: Green EDGE Certified Units verified by GBCSA using the IFC Tool.

Socio-economic Distribution and Equity: Provided 638 families with affordable housing while creating employment for over 220 people in construction over the development life.

Community Voice: Not applicable, only market research to meet the statutory requirements.