Ambition:

Seeks to generate real USD returns with low volatility; develop African debt capital markets; invest in sustainable businesses with strong ESG focus; create an alternative asset class for African and international pension funds; support African infrastructure development; support financial inclusion and deepening of the financial markets

• Climate and Environmental Action: Not core focus area of the fund; coal on exclusion list, removing upstream oil from the investment universe

• Socio-economic Distribution and Equity: Focus on social impact via financial inclusion, infrastructure and telecoms

• Community Voice: N/A

Description of the fund

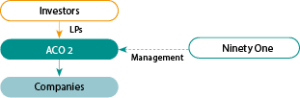

Ninety One Africa Credit Opportunities Fund 2 (ACO 2) is a senior private credit fund investing in market dominant companies in African financial inclusion, infrastructure and telecoms sectors.

Targeting development of the African Debt Capital Markets (DCM) by creating an alternative asset class, crowding in African pension funds.

Sound ESG management system, supporting companies contributing to the SDGs.

Manager

Founded in 1991 as Investec AM, Ninety One is based in London and Cape Town and dual-listed on the London Stock Exchange and the Johannesburg Stock Exchange, with $180.6 billion global AUM.

Ninety One is a leading investor in African private credit since 2008, with 18 previous African private credit funds.

21 offices across 14 countries (including emerging markets), with over 1,150 employees.

Investors

Allianz, South African pension funds, US endowment.

Key attraction points for institutional investors

- Scale

- Low correlation strategy (against US/Europe) and attractive returns versus other credit strategies

- Experienced team with deep track record

- Sound ESG management system

Key challenges for institutional investors

African focused strategy; return expectations for Africa; capacity to do due diligence in Covid-19 period.

Key Terms

Fund level

- Vehicle/fund type: Closed-end debt fund

- Fund size: Actual $165 million, target $300 million. Final close December 2021

- Blending and/or TA: No

- Sponsor/anchor: Allianz, Towers Watson SA, Riscura

- Term/investment period: 6.5 years / 4.5 years

- Target return: Target gross returns at 3 month USD Libor + 6%

- Management fee: 1.35% (discounts for size of ticket)

- Vintage (first close): 2019

- Co-investment rights: Case-by-case basis

Investee level (investment strategy)

- Instrument(s): Private credit and public credit, including loans, bonds, convertibles and asset finance

- Target investee type(s) and client segment: Market dominant African companies and other well-structured transactions

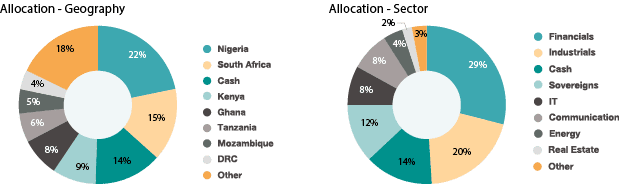

- Target sector(s): Consumer, financials, industrials, infrastructure, real estate, services, telecoms

- Target geography(ies): Africa with 15 core geographies

- Investment tenor: 3-6 years

- Average ticket size: $10-25 million

- Investment currency: USD

Pipeline and portfolio

Market opportunity

The Problem: African private credit is still nascent; demand for Africa private credit exceeds supply.

The Opportunity: Private credit as an asset class has grown materially since 2003 with a compound annual growth rate (CAGR) of 15%, approaching $1 trillion, yet

Africa has not attracted major capital flows, leading to favourable supply/demand fundamentals; opportunity to develop African debt capital markets.

Pipeline: The African credit markets have grown and diversified; $650–$750 million credit investments per annum made across the various strategies.

Just transition in the investment process

- The fund proactively sources with an ESG lens as well as the traditional investment sourcing and vetting/strategy using their large credit team

- Strong partnership and relationship model: minimum size, rating, sector/geographic priority, market dominance and track record.

Structure & risks

Jurisdiction: Luxembourg

Legal form: Special limited partnership (SCSp)

Capital structure: All LP commitment with limited working capital facility

Key risks

| Key risks | Mitigant(s) |

|---|---|

| Geographic | 20% country limit |

| Currency | Currency and duration hedged |

| Execution | Established process using internal and external legal counsel – over 200 investee companies over last 12 years |

| Concentration | Diversification requirements: Sector limit 20%, counterparty limit 5%, country limit 5% |

Outcomes framework

Climate and social metrics

- Climate and Environmental Action: CO2 emissions for certain investee companies

- Socio-economic Distribution and Equity: Total employment, female employees, taxes paid

- Community Voice: N/A

Framework and reporting

Underlying reporting standards: ESG per IFC performance standards; UN SDGs for investee companies and IMP classifications of investee companies and portfolio level

- Transparency: Quarterly investor reporting and annual ESG report

- Third-party verification: N/A

Four main focus areas covering 75% of the portfolio:

Select areas of Just Transition enhancement

- Is there an opportunity to further the current climate and environmental linkage of the fund, from both within the energy investments and across sectors, and build other climate and environmental action aspects into the fund strategy that could be included in the metrics?

- Is there an opportunity to enhance the socio- economic measurement to include quality jobs (e.g., benefits, health and safety) as well as delineating who is covered by these products, beyond gender (underserved, rural, etc.) and could this lead to a future target?

- Could the fund enhance its Community Voice commitment, including engagement into its selection process?

Investee in the spotlight

Investing in Ghana coconut board term loan

Background

Ghana Cocoa Board (GCB) is the government owned entity responsible for marketing and export of cocoa beans from Ghana. The crop generates about $2 billion in foreign exchange annually and employs circa 800,000 farming families. The underlying trade facility has an excellent 23- year track record.

Ghana is the second largest producer of cocoa in the world with 22% market share.

Investment

African Development Bank (AfDB) African Development Bank (AfDB) is acting for an up to $600 million

multi-tranche term loan facility to GCB, which ACO2 invested into. The facility is a self-liquidating 3 year tenor structure, secured by proceeds from OECD countries’ cocoa sales contract receivables.

Impact

The investment covers various climate and socio-economic aspects. The use of proceeds helps improve the lives of the 800,000 farming families. The aim is to build efficiency, sustainability and improve yield, leading to higher subsequent income levels and thus resilience, alongside job creation. Proceeds are used as follows:

- $40m – Farm irrigation (improving yield, resource efficiency and reliance leading to furthering the sustainable farming)

- $68m – Hand pollination (creating employment opportunities and increasing farmer yields)

- $200m – Environmental rehabilitation (leading to better resilience and sustainability of the land)

- $50m – Warehouse capacity (Agri infrastructure)

- $10m – Farmer database (for building efficiency and management for micro farmers)

- $200m – Promotion of domestic processing (for greater value chain integration)

Investee in the spotlight

Investing in Globaleq energy project finance

Background

Globeleq is powering Africa’s growth through the development and operation of utility scale power plants across the continent.

Founded in 2002, Globeleq has become a power industry leader by operating or acquiring interest in multiple power facilities across the world with its focus on the African continent. In 2014 and 2015, Globeleq started changing strategy to focus more on Africa and formed Globeleq Africa.

Under the ownership of shareholders CDC (70%) and Norfund (30%), the cornerstone of their strategy is to be the trusted, reliable and committed partner of choice within the African IPP industry.

With a portfolio of 13 power plants located in Tanzania, South Africa, Côte d’Ivoire, Cameroon and Kenya, Globeleq currently generates more than 1,400 MW, with another 2,000 MW in development.

Investment

To increase the scale in Africa, ACO 1 provided project finance for their expansion into Cameroon by purchasing two grid stability plants.

Impact

Globeleq is a leading green African infrastructure sponsor, aiming to build a Just Transition in the African power sector.

By providing clean power, Globeleq helps facilitate the growth and social development of African countries in a climate- aligned way.

Globeleq’s power capacity:

- 866MW gas

- 219MW solar

- 165MW wind

- 88MW heavy fuel oil