The Danish Climate Investment Fund (KIF) extends funds through equity and mezzanine financing to low-carbon and climate-resilient projects in low- and middle-income countries. KIF’s portfolio companies contribute to reducing greenhouse gases (GHGs) and to adapting to climate change. Risks are mitigated through a preferred returns structure.

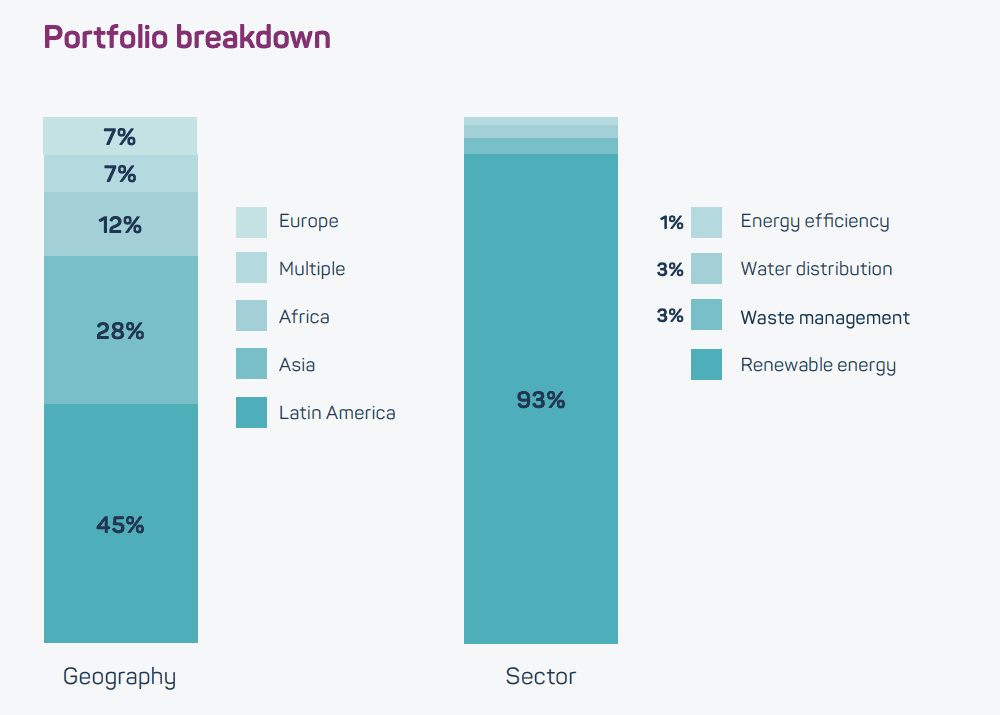

Geography: Latin America, Asia, Africa, Eastern Europe

Size: Around USD 220 million (raised)

Impact thesis: Climate mitigation and adaptation

Fund manager: Investment Fund for Developing Countries (IFU)

Total assets under management (AUM): EUR 836 million

IFU is an independent development finance institution (DFI) owned by the Government of Denmark. IFU was established in 1967 and focuses on investments in emerging markets. IFU and the funds it manages have invested in 1,300 companies across 100 countries in Africa, Asia, Latin America and parts of Europe, committing around USD 3.64 billion in capital.

Investment overview

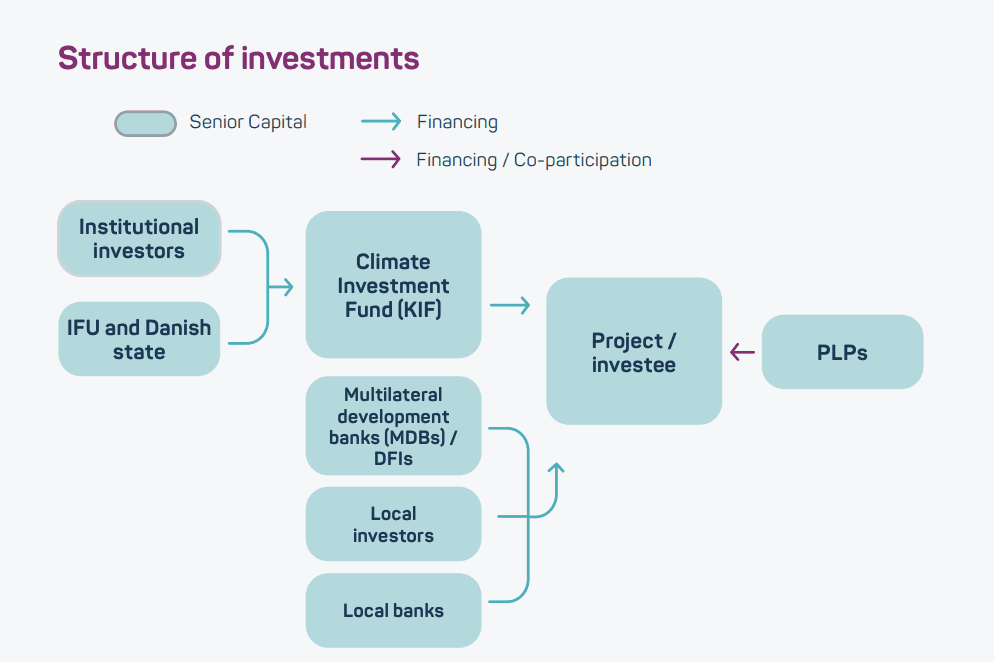

| Key fund limited partners (LPs) / Investors | Pension funds: PensionDanmark, Pensionskassernes Administration (PKA) and PBU – the occupation pension scheme for early childhood teachers and youth educators in Denmark (60%) |

| Other investors | IFU and Danish state (40%) |

| Instrument type | Infrastructure equity and mezzanine |

| Investment size in portfolio companies | USD 6-8.8 million on average, USD 1.8 million min. |

| Time horizon | 10-year closed-end fund (2012-2022) |

Financial return profile

Returns: Market-rate

- Target 12% per annum internal rate of return (IRR)

- Preferred returns of 6% per annum IRR for private limited partners (PLPs)

Track record:

- IFU has a track record of over 10 years of investment returns outperforming emerging market listed stock indexes

Liquidity:

- 10-year closed-end fund

Risk profile

Currency risk: Not hedged, focus on diversification of currencies

Concentration risk: KIF cannot invest more than 30% of its capital in a single country

Execution risk: KIF cannot invest more than 20% of its capital in a single project

Other risk mitigation:

- PLPs receive preferred returns up to 6% per annum

- Investment committee includes pension fund CEOs with veto power

Investment thesis

With a portfolio spanning 100 countries, IFU offers a consistent pipeline of deals with strong returns.

The fund’s preferred returns structure mitigates risks, ensures competitive returns for PLPs and incentivises IFU to pursue high returns:

- All parties receive distributions until investments are returned

- PLPs receive returns up to 6% per annum

- Danish state benefits from catch-up period until all parties receive 12% per annum

- Returns larger than 12% per annum distributed pari passu with a 10% premium to Danish state

Investment selection

Eligible investments

Investment committee which includes pension fund CEOs determines investments. Eligible sectors include:

- Renewable energy

- Energy efficiency

- Alternative energy

- Transport

- Material and equipment providers

- Other projects that reduce GHG emissions

Due diligence approach

- Clearance in principle: Evaluation of project background, partner financials, business idea, country analysis, indicative financing structure, ownership structure, and Corporate Social Responsibility (CSR)

- Binding commitment: Business plan development including 10-year financial model, sensitivity analysis, CSR review and assessment of climate and employment impacts

Impact targeting

Impact thesis

Theory of change:

- Reducing GHGs and/or adapting to climate change helps mitigate the climate burden on communities

- Renewable energy projects provide sustainable employment and increase access to energy

Target stakeholders: Local communities in emerging markets benefit from reduced poverty and long-term job creation

Impact metrics and outcomes

IFU reports key performance indicators (KPIs) to investors. CO2 emission data is verified externally.

- Project metrics – mitigation: Project-lifespan GHG emissions avoided are estimated annually for new projects

- Project metrics – adaption: Climate-related project costs (incremental investment and operating costs due to climate change) are relative to total costs estimated annually for new projects

- CSR metrics: Key metrics include:

- i) environment,

- ii) occupational health and safety,

- iii) human rights and labour practices and

- iv) anti-corruption.

- These are assessed annually for active projects and on exit

- Development impact metrics: Key metrics include

- i) direct employment,

- ii) workers trained in environmental matters,

- iii) partner mobilisation and

- iv) project sustainability and profitability,

- assessed at appraisal and on exit

Portfolio investee spotlights

Lake Turkana Wind Power (LTWP), Kenya

Wind farm – Renewable energy

LTWP is the largest wind farm in Sub-Saharan Africa (310 megawatt). KIF’s investment of around USD 13.8 million helped install 365 wind turbines and secured a purchase agreement with the Kenyan state electricity company.

The wind farm provides around 15% of Kenya’s installed electricity generating capacity at around USD 0.086 per kilowatt-hour, half the cost of fossil-fuel-generated electricity, and will replace around USD 120 million worth of fuel imports annually. KIF’s investment directly created 262 jobs with 96% of LTWP’s workforce coming from the local Marsabit county.

Rochem Separation Systems, India

Wastewater recycling – Water sustainability

Rochem Separation Systems has developed energy- efficient wastewater recycling and zero-liquid- discharge solutions that recover 75 to 80% of water from wastewater.

KIF partnered with Rochem, investing around USD

2.5 million to establish the wastewater management solution provider Roserve. Roserve will expand water recycling in India, reducing fresh-water usage, energy consumption and industrial costs. Roserve now has 30 wastewater plants. KIF’s investment is expected to directly create 65 jobs.

Institutional investor spotlight: PKA

Investment: Around USD 31.5 million

Driven by the interest of their members, PKA has invested in a range of climate projects including offshore wind farms, forestry and green bonds. As of 2019, 10% of PKA’s fund (over USD 4 billion) was invested in sustainable investments.

PKA has a successful and growing relationship with IFU, committing additional capital to subsequent funds including:

- Around USD 35 million to the IFU Danish Agribusiness Fund to boost food production in developing countries in 2016

- Around 63 million to the IFU SDG Investment Fund to help achieve the Sustainable Development Goals in developing countries in 2018

“Sustainable investments are important to our members. PKA’s efforts to invest responsibly are therefore about the ability to maximise the amount our members will have in retirement at the same time as making sure they retire into a sustainable economy, society, and environment.”

Peter Damgaard Jensen, former CEO of PKA

Other similar opportunities in the market

- IFU have continued to develop de-risked equity funds

- IFU’s Danish Agribusiness Fund, launched in 2016, received financing of around USD 110 million from a further collaboration between IFU, the Danish state and pension funds, including around USD 31.5 million each from PensionDanmark and PKA

- IFU’s SDG Investment Fund, launched in 2018, has capital commitments of around USD 750 million with private capital commitments of around USD 450 million, including commitments from six pension funds each worth around USD 63 million

Key observations for institutional investors

Impact investment can deliver impact and attractive returns

- Preferred returns structures enable PLPs to receive competitive financial returns for impact investments, protecting private capital returns while also providing a positive incentive for funds to prioritise high returns

- Forgoing initial returns means that IFU is positively incentivised to prioritise high returns in portfolio selection

Investable impact opportunities are available at scale

- KIF demonstrates the availability of vehicles for institutional investors to make sizable impact investments

- Average KIF investments in portfolio companies are between USD 6 and 8.8 million

Partners can provide emerging markets expertise to manage investments

- An emerging-markets-focused partner such as IFU can provide the experience and expertise to allow institutional investors to build familiarity with targeted returns and proposed investment portfolios in new markets

- IFU and IFU-managed funds have co-invested in 1,300 companies in 100 countries across Africa, Asia, Latin America and parts of Europe

- This allows IFU to provide targeted, local expertise to investment partners

Institutional investor engagement mitigates risks

- Institutional investor engagement in fund investment decisions mitigates the potential risk that DFIs will sacrifice returns for other priorities during portfolio selection

- The KIF investment committee includes pension fund CEOs, ensuring that investment selection is aligned with institutional investor priorities