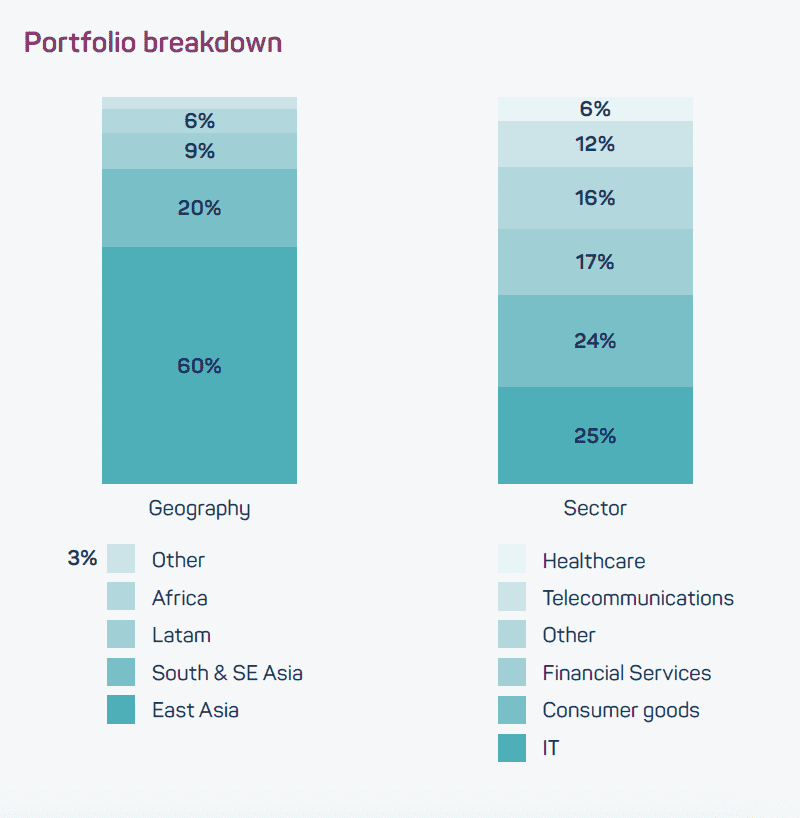

The Emerging Markets Sustainable Impact Fund is a public equity accumulating sub-fund under Nomura Ireland plc. The fund is an actively managed portfolio of emerging market equities launched in March 2020, investing in companies contributing to the 17 Sustainable Development Goals (SDGs). The diversified nature of the sectors contained in this portfolio has increased the fund’s resilience to shocks.

Geography: All emerging

Size: EUR 63 million (raised)

Impact thesis: Multiple Sustainable Development Goals (SDGs)

Fund manager: Nomura Asset Management

Total assets under management (AUM): Around USD 494 billion

- Nomura Asset Management is a global investment manager established in 1959 headquartered in Tokyo with 14 offices in Asia, Europe and America

- Nomura has a long-term track record of managing global and regional equities including in emerging markets

Investment manager: American Century Investments

- American Century Investments is a global asset manager founded in 1958, based in the US, UK, Hong Kong and Sydney, primarily owned by the Stowers Institute for Medical Research

- It offers advisory services, investment strategies and direct investment management for asset managers

- It is focused on delivering financial returns, while contributing to research and impact through its ‘Prosper with Purpose’ approach and has significant experience in emerging markets

Investment overview

| Key fund limited partners (LPs) / Investors | Government Pension Fund of Norway |

| Instrument type | Public equity fund |

| Portfolio investment size | EUR 63 million, fund capped at USD 500 million |

| Initial investment | USD 1 million for institutional investors (I Class) |

| Fee structure | 0.95% management fee, other expenses up to 0.2% |

Financial return profile

Returns: Market-rate

- +7% above benchmark [MSCI Emerging Market Index] for year 2020

- Price to earnings ratio 19.8x

Liquidity:

- Publicly listed equity

- Small levy imposed on sale within the first year

Risk profile

Business / concentration risk: Each equity will be no larger than 5% of total portfolio – currently 65 holdings, targeting 80-90

Liquidity Risk: Focus on markets with larger publicly traded equity markets, and only purchase small shares of companies

Investment thesis

Focus on growth and impact:

- The fund conducts an extensive ‘fund building’ process to identify companies with accelerating growth and scaling impact

- The fund’s philosophy is that investing in growth and ‘SDG relevance’ is more highly correlated to stock price performance than absolute current earnings

- The fund therefore does not require a minimum threshold of earnings or revenue for its investees, focusing rather on other metrics

Investment selection

Eligible investments

Exclusions: Violations of the United Nations Global Compact Principles, exclusions lists recommended by the Government Pension Fund of Norway and others

SDG alignment: Analysts’ proprietary research culminates in an impact thesis that explains current or projected SDG alignment in combination with the stock’s fundamental growth profile

Due diligence process

The portfolio is developed through a three-step investment process:

- Idea generation: Assessment of around 300 companies making contributions to the SDGs and exhibiting accelerating growth

- Fundamental analysis: Research on around 200 companies to ensure acceleration is sustainable and validate SDG impact through a careful impact and Environmental, Social and Governance (ESG) review

- Portfolio construction: Actively select top-rated companies on growth, impact and SDG spread

Impact targeting

Impact thesis

Theory of Change:

- The fund provides financing to growing businesses that are directly contributing to one or more SDGs and can provide a compelling impact thesis

- It primarily focuses on SDG 9 – Industry, Innovation and Infrastructure (72%), SDG 8 – Decent Work and Economic Growth (25%) SDG 1 – No Poverty (23%) and SDG 11 – Sustainable Cities (22%),

Target stakeholders: SDG-focused businesses in emerging markets and their customers

Impact metrics and outcomes

- Selected companies will be closely engaged to confirm their SDG alignment and progress toward SDG impact, including developing customised SDG Key Performance Indicator (KPI) frameworks for each investee company

- The fund will release an annual report on the portfolio’s investment allocation per SDG and stock-per-stock assessment of impact achieved

- The first impact assessment report will be released in 2021

Portfolio investee spotlights

Top Glove Corporation

Malaysia – Health

Top Glove is a producer of medical-grade rubber globes for the health industry. It is currently the fund’s 6th largest holding, growing to be the largest glove personal protective equipment (PPE) distributor globally.

The company recently witnessed significant growth due to the surge in demand for PPE during the COVID-19 pandemic, supplying major health services across South East Asia and globally.

Key observations for institutional investors

Diversification can mitigate external shocks

Given the diversified nature of the sectors contained in this portfolio, including health sector manufacturers, the negative shock of the COVID-19 pandemic was less severe

Sources:

Sources: i) Fund Overview and Factsheet: American Century Emerging Markets Sustainable Impact Equity Fund