Esmée Fairbairn Foundation is one of the UK’s largest independent funders. It was founded in 1961 by Ian Fairbairn, a pioneer of unit trust investments, and his two sons, and named in memory of his late wife. Esmée funds projects in the arts, education and learning, the environment and social change, especially areas where other funders are unlikely to be available. Its core aims are to improve the natural world, secure a fairer future and strengthen the bonds in UK communities.

Matthew Cox, Investment Director, and Jonny Page, Head of Social and Impact Investing explain how the endowment has incorporated sustainable, social and impact investment – and their working relationship with their advisers, Cambridge Associates.

How is the endowment of the Esmée Fairbairn Foundation structured?

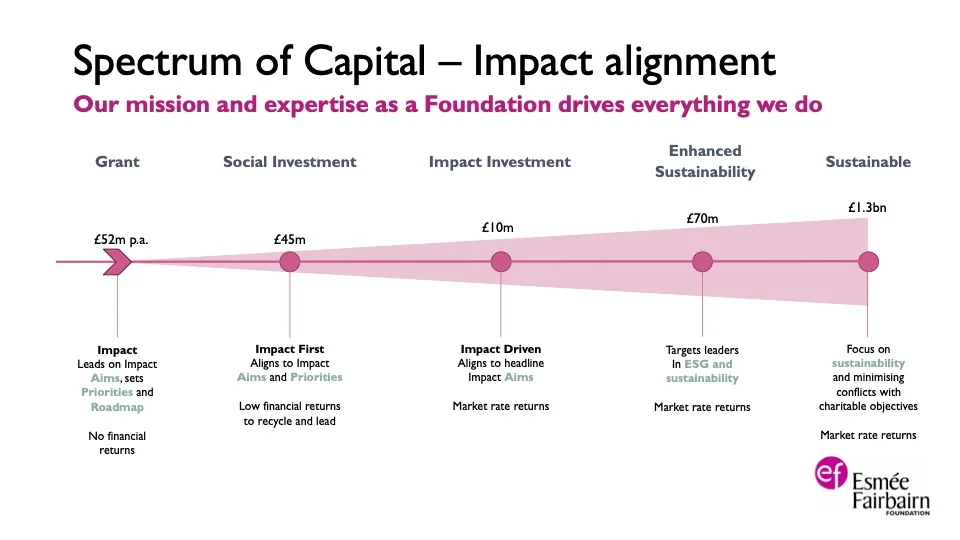

Matthew: The endowment holds £1.93bn in assets. Of that, a third is in illiquid investments, roughly 10% is in hedge funds, 5-10% is in more debt-related instruments, and the rest is global equities and a little bit in cash. Capital is allocated across the spectrum of capital – ranging from sustainable and impact investments seeking market-rate returns to social investments that accept lower financial return, then of course our grant-making, which has no financial return (see Figure 1).

Figure 1: Esmee Fairbairn’s spectrum of capital allocation

Who manages the investments?

Jonny: Cambridge Associates manages our Sustainable and Enhanced Sustainable allocations. The £45mn social investment allocation and a £10mn impact investment allocation are managed in-house by our Social and Impact Investing team, which I head up.

Does Cambridge do all of the fund sourcing and due diligence for the two sustainable portfolios?

Matthew: Yes they do. If our investment committee sees an interesting investment, there is obviously nothing to stop us forwarding it on to Cambridge and saying “Have you seen this?” but that is all we do. If it’s an idea they can use – great, if not that’s fine as well. We definitely want Cambridge’s ideas to get into the portfolio so we give them full ownership. However, it is an advisory relationship rather than a discretionary one. So Cambridge Associates make the recommendations and the investment committee approve each one.

You recently raised the allocation for the enhanced sustainability allocation (ESA) from £25mn to £70mn – what was the trigger for that?

Matthew: The catalyst was that the ESA had hit its five-year track record and there was enough confidence in its success and our relationship with Cambridge to increase exposure.

The idea behind the ESA is to accommodate investment ideas that might not have otherwise made it into the more mainstream sustainable portfolio. That can include organisations that are less established, or a team that is left one organisation to start their own shop and therefore don’t yet have the necessary track record in their new environment. Or it could be a very small fund that is well aligned with our foundation in some way thematically. So the ESA is also an opportunity to bring together potentially great sustainable managers of the future.

The impact investing allocation was created in 2021 – what was the spur for that?

Matthew: We had been following the impact investing market for some time. We had known the Impact Investing Institute since its formation, as well as the various committees which led to it. As funds became more vocal about incorporating impact into their portfolios, we brought the idea to the attention of our trustees. Initially some were sceptical so we invited Elizabeth Corley, chair of the Impact Investing Institute, to come and speak. That led to a wider a recognition this is a pretty interesting area – and one in which Esmée should be involved.

So the decision was taken to start with a £10mn pilot allocation, comprising ten £1mn investments to reflect the higher-risk profile of the opportunities we would be looking at. We made the first £1mn investment just before Jonny joined in May 2022 and we’re now on our third.

What areas of investment are you looking for the impact portfolio?

Jonny: We have taken a very thematic view in terms of what lines up with Esmée’s mission and grant-making strategy. We are also focusing on potential ‘alpha generation’ opportunities by looking at areas where there may be regulatory, policy or other macro tailwinds.

Sustainable food and regeneration are two big themes in the portfolio. We are also exploring how impact priorities overlap – in terms of, say, nature-based solutions, food, regeneration, and the circular economy – and hope we can ultimately share that thinking with other investors.

How does reporting and measurement differ for the different parts of the endowment?

Matthew: In the main sustainable portfolio, we are not at the stage where we are formally measuring impact. We have the usual screening on carbon emissions generated by the portfolio and anything that’s conflicting with some UN conventions, so we know what’s in there, but we’re not yet using, say, the Impact Management Project (IMP) framework. Ideally, we’ll get to that at some point.

For the Enhanced Sustainability Allocation, Cambridge Associates’ reporting is really rigorous and robust. But at the moment it focuses on measuring the environmental, social and governance risks in the portfolio, rather than the impact being made. So we’re not at the stage of measuring the ‘additionality’ coming from the investments we’re making in the ESA.

Jonny: Our measurement and monitoring for the impact investing pot follows the same process we use for our social investments. Specifically, we have three KPIs per fund that we monitor.

The first KPI is about outcomes: what is the social or environmental outcome or output of the fund and what change is that fund is geared to address? The second KPI is organisational and assesses whether our investment is strengthening what we believe to be an impactful fund manager. Then the third KPI relates to the market: what is this investment signalling to the market and how is it helping to develop a wider impact investing market? So it is a simple process but pretty rigorous.

What does best-in-class responsible investment reporting look like for you?

Matthew: For us, reporting is primarily about trying to produce something that is straightforward and readable for our investment committee. Cambridge Associates provides us with reporting on investment managers, which has evolved over the last few years.

In the past we had a fairly basic traffic-light system to rate managers on responsible investment. It now details aspects such as which managers are trying to encourage their portfolio companies to adopt science-based targets for reaching net zero. Or which managers have voted against company directors if they are saying something but it is not backed up with action. So the assessment has become increasingly detailed but at the same time, we do not want to drown in data.

Cambridge Associates use a lot of external feeds such as Sustainalytics or MSCI fund ratings to inform their reporting but we are keen that they do not just use these systems. We also really want Cambridge’s own view and overlay, especially given that impact investing is often about investing in things that do not look best-in-class now but that are going to change in the future.

After all, if you are a long-term investor and can invest in a company before it makes a dramatic change that is often where the greatest value is created, both in terms of financial return and impact.

Diversity, equity and inclusion is a big focus for you. What areas or ideas are you exploring?

Jonny: One thing that really drives us is the shocking statistic that 94 or 95% of all venture-capital funding goes to all-male-led GP teams. So we absolutely do have a lens on our investing to ensure that we are being inclusive of female-led general partners (GPs).

In fact, all three of our first impact investments have been to female-led GPs. That’s not because we specifically targeted female-led GPs but because we’ve made sure that our approach is as inclusive as we can make it.

As part of our aim for a fairer future, we are focusing on race justice, gender justice and migrant justice. So those three areas can inform where we might invest. But we can also apply them to the operational side of the funds we look at.

You have a very productive relationship with Cambridge Associates – what’s been the key to that?

Matthew: At the end of the day, it really comes down to the people on the team. Whenever we have reviewed our investment advisers, we have not just looked at the capabilities they provide. There also has to be a chemistry or a cultural fit.

Also, Cambridge Associates tend to hire people who have actively taken a decision to join a consultant working with charity clients. So a lot of their staff personally feel quite passionately about some of the causes we pursue.

We also fortunate that we have a lot resource internally compared to a lot of charities. So we have the time to interact with our adviser teams and spend time on investment matters.

Is there anything that you would say to encourage other charities and foundations to introduce an impact investing component to their endowment?

Matthew: One thing I have realised is that asset owners are the key to the whole financial system. Investment advisers and fund managers and other professionals are simply there to provide a service to people’s money. So if enough owners of that money ask for something, that’s when an industry really changes.

For example, if we ask funds to provide DE&I data on portfolio companies as part of their due diligence, the fund has to ask companies to start gathering that data, which in turn requires companies to justify their own practices.

Asset owners are in a very privileged position: if trustees of charities or pension funds say they want something and they are willing to vote with their feet if they do not get it, that is when the system can change.

Jonny: One additional point: whenever a foundation is asked how they began investing for impact, they say “We just started – we made a small allocation and just started to learn”. That is what we did with social investment, that is what we are doing now with impact investing, and that is what we would urge other foundations to do.

Second, it is also about the weighting we give to impact in terms of importance. If we all had as much of a blind spot around financial metrics, we would just go and find the data we need, because no asset owner wants to be in the dark about the financial upside or downside being created in their portfolio. Impact is the same: we each generate a negative, neutral or positive impact through every single investment we make. So it should be as important to know what those impacts are. If we could get that culture into investment committees, I think that would be half the battle.