The African Development Bank Group (AfDB) Social Bonds programme finances projects with a measurable, positive social impact. AfDB Social Bonds enable investors to support the Sustainable Development Goals (SDGs), while benefitting from financial returns, de-risked through AfDB’s strong track record and network.

Geography: Africa

Size: EUR 500 million (raised)

Impact thesis: Multiple Sustainable Development Goals

Fund manager: African Development Bank Group

Capital: USD 208 billion

- AfDB (founded in 1964) is an AAA-rated multilateral development bank including 81 member states with a mandate to support sustainable economic development and social progress across Africa

- Authorised capital is subscribed to by 54 African and 27 non-African member states

- The EUR 7-year Social Bond is part of the AfDB Social Bonds programme (launched in 2017) which includes five social bonds totalling around USD 5.3 billion

Investment overview

| Key fund limited partners (LPs) / Investors | Pension funds & insurers (10.8%), asset managers (15.8%), banks (22.2%), central banks and official institutions (50.9%) |

| Instrument type | Private debt (social & sustainability bond) |

| Time horizon | 7-year bond (2017 – 2024) |

Financial return profile

Returns: Market-rate

- Coupon: 0.25% annual

- Yield on realised returns to date 0.354% annual

Rating: AAA

Liquidity:

- Publicly listed on Luxembourg Stock Exchange

- Bond three times oversubscribed at launch

Risk profile

Currency risk: EUR denominated bond backed by AfDB balance sheet, no currency hedging

Execution risk: Local presence, established track record for social-focused projects

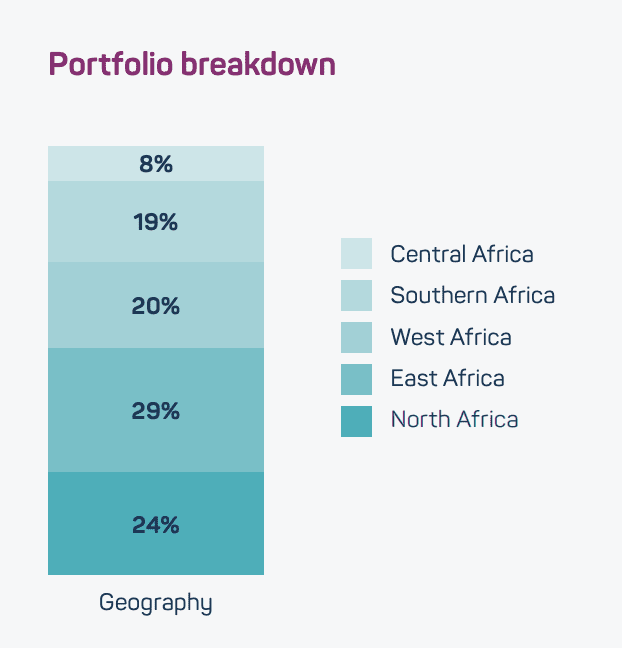

Concentration risk: Geographically diversified portfolio

Political risk: Close relationship with 54 African member states

Investment thesis

- The EUR 7-year Social Bond is part of the AfDB Social Bond programme, raising financing for eligible AfDB projects with potential social-focused impact

- The Bond is a fixed-coupon social bond backed by the balance sheet of AfDB, an AAA-rated multilateral development bank; investor returns are not dependent on outcomes

Investment selection

Eligible investments

Projects financed by AfDB Social Bond proceeds must:

- Be approved by AfDB’s Board of Directors

- Provide / promote social outcomes: i) affordable basic infrastructure, ii) access to essential services, iii) access to financing / financial services, iv) affordable housing, v) employment generation, vi) food security, and vii) socio- economic advancement and empowerment and others

- Target African populations

Projects must have clear social outcomes and lead to significant poverty reduction, job creation, and inclusive growth.

Due diligence approach

- Screening: AfDB operations departments identify social impact projects, AfDB’s Integrated Safeguards System is used to systematically assess environmental and social impacts and risks

- Selection: Portfolio jointly agreed by AfDB’s operations and treasury departments; only projects with a predominantly social-focused impact are included in the review

Impact targeting

Impact thesis

Theory of Change: Poverty reduced through projects that target inclusive growth and job creation across ages, genders and geographies

Target stakeholders: African communities with a focus on women and youth

Impact metrics and outcomes

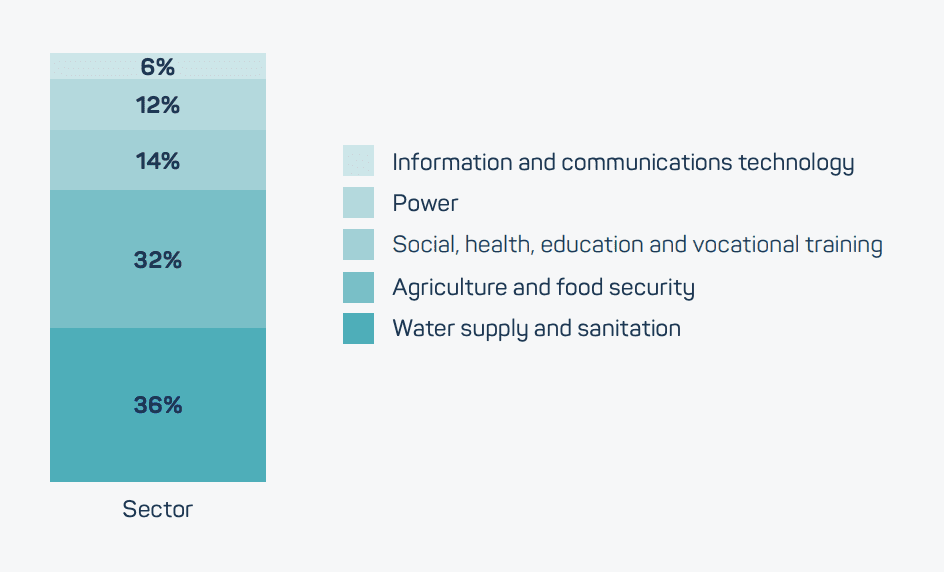

Impact metrics: AfDB uses project-specific outcome metrics across sectors including:

- Agriculture and food security

- Education and vocational training

- Energy / rural electrification

- Financial inclusion and housing finance

- Health

- Information and communications technology

- Water supply and sanitation

Key Performance Indicators (KPIs): Two KPIs tracked across all projects:

- Number of jobs created

- Number of people impacted, with a focus on women and youth

Reporting: An annual newsletter reports key impact metrics and social outcomes for portfolio projects and disclosures on disbursements and allocations to social projects.

Portfolio investee spotlights

Agricultural value chain development project, Cameroon

Agriculture

The project enhances competitiveness of three agricultural value chains (oil palm, banana and pineapple), building 1,000km of rural roads, 30 warehouses, 15 rural markets, 30km of electricity networks, 30 drinking water systems, and a quality control laboratory. AfDB invested EUR 89 million, financing 78% of the project.

AfDB’s investment will create 6,200 jobs and reach 864,830 people, generating an average increase of USD 1,080 in annual income for beneficiary households.

Arusha sustainable urban water and sanitation delivery project, Tanzania

Water supply and sanitation

The project provides safe, reliable and sustainable water and sanitation services in Arusha through improved infrastructure. AfDB invested USD 144 million, providing 61% of the project’s financing.

The project will increase access to water and sanitation in Arusha from 65% to 100% and is predicted to reduce the infant mortality rate by 20% through a reduction in waterborne diseases.

Institutional investor spotlight: Japan’s Government Pension Investment Fund (GPIF)

Investment: Around USD 120 million

GPIF signed a strategic partnership with AfDB in 2019, committing to investments in their Social and Green Bond programme, including the EUR 7-year Social Bond.

In total, GPIF made more than USD 3 billion investments in green, social and sustainability bonds in 2019. GPIF also works with World Bank and the International Finance Corporation among others, to further support Environmental, Social and Governance (ESG) integration into fixed-income investments.

“GPIF demands our asset managers to integrate ESG into their investment process from analysis to investment decision. We regard the purchase of green, social and sustainability bonds as one of the direct methods of ESG integration in the fixed income investment. GPIF wishes to contribute to make green, social and sustainability bonds mainstream investment products in order to ensure the sustainable performance of the pension reserve fund for all the generations.” Hiro Mizuno, Former Executive Managing Director and CIO, GPIF

Other similar opportunities in the market

- Social bonds saw record growth in 2020, jumping nine-fold to $165 billion (excluding sustainability and green bonds), driven by the demands created by the Covid-19 pandemic

- Subsequent social bond issues by AfDB include: EUR 10-year Social Bond (EUR 1.25 billion), NOK 3-year Social Bond (around USD 54 million), USD 3-year “Fight-COVID-19” Social Bond (USD 3 billion) and SEK 3-year “Fight-COVID-19” Social Bond (around USD 280 million)

Key observations for institutional investors

Development Finance Institutions (DFIs) & development banks offer lower risk exposure to emerging market investments

- AAA-rated DFIs / development banks have safe balance sheets that offer low risk exposure to emerging market impact investments and limit currency risk

- The EUR 7-year Social Bond is a Euro-denominated fixed- coupon bond backed by AfDB’s balance sheet

Partners can provide local expertise to reduce uncertainty

- DFIs / development banks have deep local research capabilities and experience in the markets in which they operate, reducing uncertainty

- AfDB has almost 60 years of experience operating across Africa and a strong local presence creating a large pipeline of projects and allowing thorough due diligence

Relationships with local governments reduce political risk

- Long-standing DFIs’ / development banks’ connections to local governments may reduce political risk in emerging market investing

- AfDB has 54 African member states and working relationships with the governments of states in which it operates

Liquid emerging market impact opportunities are available

- Listed social bonds offer liquid assets which can be used to move into emerging market impact investments

- The EUR 7-year Social Bond is listed on the Luxembourg Stock Exchange, regulated to international standards, and was three times oversubscribed at launch

Sources:

Sources: i) afdb.org [accessed: 01.10.20], ii) GPIF, GPIF and AfDB launch initiative to promote Green and Social Bonds (2019), iii) Impact Invest Lab, The Social Bond market: towards a new asset class? (2018), iv) S&P Global, A Pandemic-Driven Surge In Social Bond Issuance Shows The Sustainable Debt Market Is Evolving (2020