The Nutritious Foods Financing Facility (N3F) is an impact-first, child-inclusive fund that focuses on access to nutritious foods for households, with children as a key priority.

“Investing in proper child nutrition not only ensures healthier individuals, it contributes to sustainable development by breaking the cycle of poverty and enhancing resilience to economic shocks.” – Roberta Bove, Senior Lead – Innovative Finance, GAIN

Strategy

Access to finance is a major barrier for agri-food small and medium enterprises (SMEs), especially those producing highly nutritious foods like fruits, vegetables and dairy. Globally, only around 5% of impact assets are allocated to food and agriculture, with only a small share reaching SMEs – largely due to perceived risks and a lack of clear impact metrics. N3F was designed to overcome these barriers.

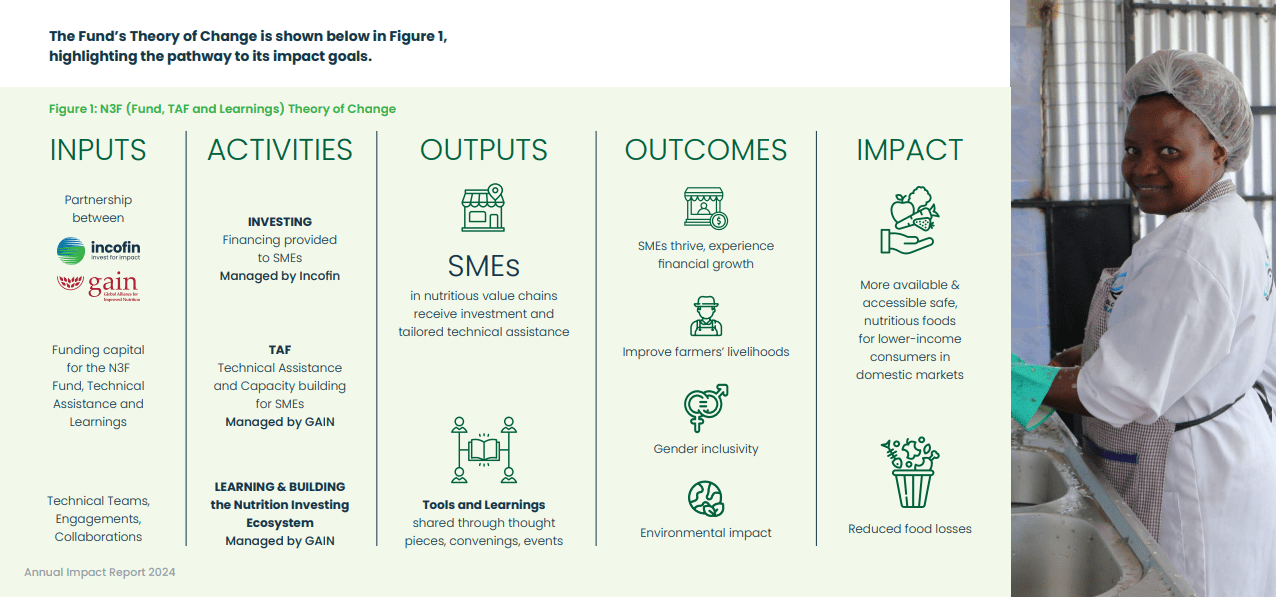

N3F uses a blended finance approach to support SME’s producing and distributing safe, affordable and nutritious foods for low- and middle-income households in Sub-Saharan Africa. By combining debt financing with technical assistance, the Fund helps these SME’s scale. Support focuses on enhancing the nutritional quality of products, strengthening supply chains, advancing gender equality and reducing environmental impacts. Ultimately the fund aims to support positive long-term child health and development outcomes.

| Attribute | Details |

| Manager | Incofin |

| Technical Assistance & Nutrition Impact | Global Alliance for Improved Nutrition (GAIN) |

| Fund/Product Name | Nutritious Foods Financing Facility (N3F) |

| Status | Open-ended |

| Asset Class | Private Debt |

| Target Sector(s) | Agriculture – Nutritious foods |

| Target Geography | Sub-Saharan Africa (LMICs) |

| Time Horizon | Indefinite |

With USD 11.5 million in initial capital, the Fund operates as an open-ended vehicle with a significant first loss tranche and two other share classes offering different risk, return and liquidity profiles. This structure means the fund address both immediate nutrition needs and long-term development outcomes, including learning, health and resilience. Risk is mitigated through rigorous pipeline validation and partially grant-funded technical assistance, helping SMEs overcome barriers and grow sustainably. The Fund is managed by Incofin, with technical assistance and nutrition impact support from GAIN.

Applying a child lens to investing

N3F’s key impact metrics span across nutrition, employment, gender, environment and consumers and suppliers.

Children are a central focus: in its first year of operation, investees reached nearly 3 million consumers, 44% of whom were children, delivering 647.3 million nutritious food servings (which could reach an estimated nearly 3 million end consumers across Sub-Saharan Africa).

“Adequate nutrition during childhood (up to age 18 years) is the bedrock for physical growth, cognitive development, and overall health. Proper nutrition also provides children with the energy needed to play – an essential ingredient in their development and emotional wellbeing. Well-nourished children are more likely to perform better academically, exhibit higher cognitive abilities, and be more productive as adults. Meanwhile, children with malnutrition – which can include undernutrition and overweight/obesity — can have a higher risk of mortality and illness as children and of chronic diseases, such as diabetes and cardiovascular disease, in adulthood. Improving nutrition may be the best investment we can make in children.”

– Roberta Bove, Senior Lead – Innovative Finance, GAIN

Measuring impact

The Fund is intentional about tracking how its investments benefit children, aiming to be fully child-inclusive according to the UNICEF Child-Lens Investing Framework.

Child-focused data collection:

- Age- and gender-disaggregated data is collected to understand how households consume nutritious foods.

- The Fund is piloting a child-lens survey module, co-developed with 60 Decibels and UNICEF, for their next investees in 2025. This will integrate child-lens principles into impact monitoring practices.

Nutrition impact monitoring:

- GAIN leads the N3F fund’s nutrition impact monitoring, focusing on key outputs in the theory of change, (i.e., the direct results of the N3F’s work, such as volumes of nutritious food produced) using annual data collection on investees, aligned to IRIS+ standard indicators where feasible.

- To complement firm-reported data, GAIN works with 60 Decibels to conduct “lean data” surveys. These provide insights on ‘investee clients’, including farmers and consumers, covering dietary diversity, income, gender and child-specific nutrition outcomes. Findings are published annually to inform the wider nutrition investing community.

Frameworks and standards used:

- UN Sustainable Development Goals (SDGs)

- UNICEF Child-Lens Investing Framework

- IRIS+ impact measurement standards

- Proprietary nutrition screening framework

The investment case

N3F demonstrates that child-linked demand can underpin strong, scalable business models.

Since its launch in early 2024, the N3F has made 10 investments in nutrition-focused SMEs based in Kenya, Tanzania, Rwanda, Zambia, Senegal, and Uganda, operating across diverse nutritious food value chains including fortified staple foods, fish, legumes and nuts, dairy, poultry and cold-chain logistics and storage for fresh produce.

It is planned for all investees to access technical assistance, which has already been deployed to the first 8 investees, aimed at strengthening business capacity, supporting compliance with nutrition and quality standards, enhancing impact, and fostering long-term sustainability.

This case study is provided for information only and should not be interpreted as constituting investment advice or any regulated activity. The information and figures provided are accurate as per the latest information publicly available and/or made available to the Impact Investing Institute for the purpose of this research at the time of publication