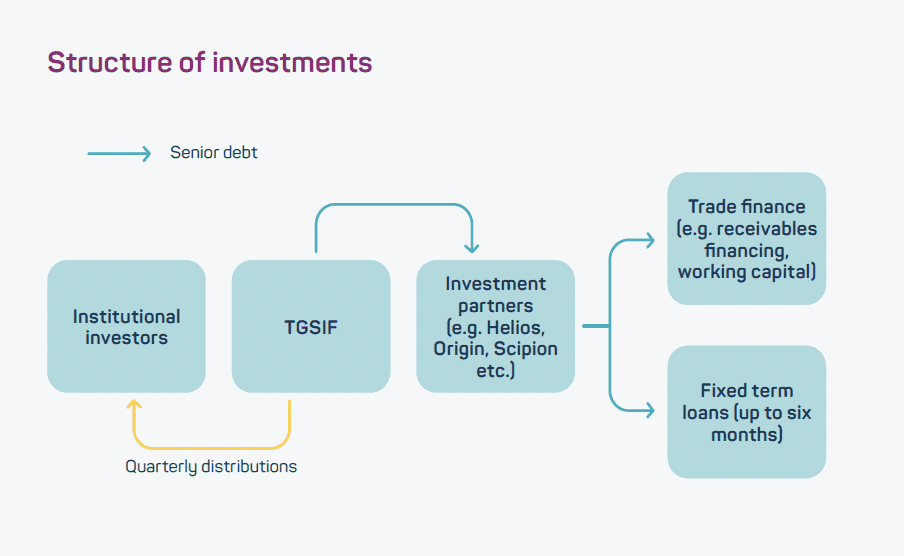

The Global Sustainable Income Fund II (TGSIF II) is the second closed-end private debt fund managed by TriLinc Global Advisors. It provides private term loans and trade finance loans to small and medium-sized enterprises (SMEs) across emerging markets to create trade and economic growth through access to finance. Investments are de-risked through TriLinc’s protected returns approach and diversified portfolio.

Geography: Sub-Saharan Africa

Size: Around USD 300 Million (raised)

Impact thesis: Financial inclusion

Fund manager: TriLinc Global Advisors

Total assets under management (AUM): Around USD 1.4 billion

- TriLinc Global Advisors is an investment manager founded in 2008, based in California

- TriLinc Global Advisors manages around USD 1.4 billion in investments focused on financial inclusion of small and medium businesses across developed and developing countries

- It seeks to combine competitive risk-adjusted financial return with measurable social impact

Investment overview

| Key fund limited partners (LPs) / Investors | Pension funds: Christian Super, an Australian superannuation fund |

| Instrument type | Private debt (short-term trade finance and longer-term loans) |

| Minimum investment size | USD 500,000 |

| Time horizon | Max. one and a half year investment period, five year term, one year extension |

| Fee structure | 1.25% management fee, 20% performance fee |

Financial return profile

Returns: Market-rate

Track record:

- Double-digit gross yields across all TriLinc portfolios

Liquidity:

- Distributions paid quarterly after an investment period of one and a half years maximum, for the duration of the five year term, with a possible one year extension

Risk profile

Currency risk: Loans to companies all denominated in EUR or USD, companies assume currency risk

Credit risk: All loans over-collateralised (1x for term loans and 1.17x minimum collateral required for trade finance loans)

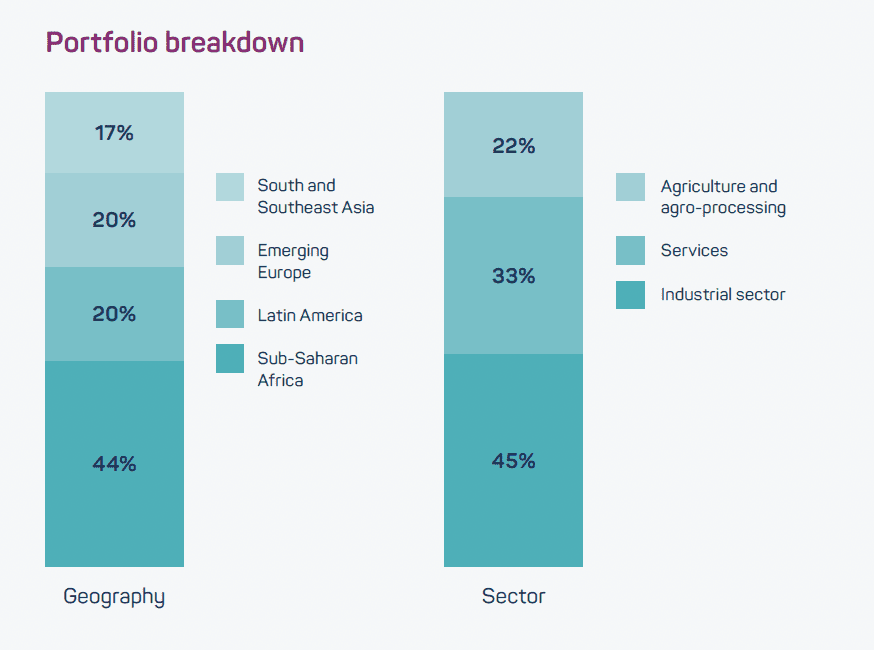

Concentration risk: Comprehensive diversification by country, borrower, industry, asset type (trade finance and term loans), investment partner and tenor (60 days to 6 months)

Investment thesis

Private Debt Plus® is TriLinc’s private debt investment strategy, which aims to deliver market-rate returns through trade and term loans and measurable positive impact. To achieve these objectives, TriLinc has adopted key risk management measures, including:

- Protected returns: The investment performance fee is subordinated to a 7% preferred return on net assets at the end of the quarter

- Impact assessment training: TriLinc works with investees to ensure their impact measurement tools are sufficiently sophisticated to provide quality reporting data

Investment selection

Eligible investments

To be selected, borrower companies need to demonstrate their intent to create positive impact in one of the following three areas:

- Building sustainable communities

- Strengthening their workforce

- Enhancing their global competitiveness

Due diligence approach

Due diligence of possible investments includes:

- Needs assessment based on geographical context and industry benchmarking

- Compliance with local legal and regulatory requirements and any other standards or certifications

- Compliance with international Environmental, Social and Governance (ESG) best practices, in particular TriLinc’s Environmental and Social Management System (ESMS) and the International Finance Corporation’s (IFC) Environmental and Social Performance Standards

- Ability to report yearly on TGSIF impact metrics

Impact targeting

Impact thesis

Theory of change: TGSIF helps growing businesses to access flexible and timely capital to scale operations. The loans are intended to support five key impact themes:

- Create jobs

- Provide growing incomes for employees

- Increase taxes to local government institutions

- Drive local production of quality goods and services and

- Propel growth of communities

Target stakeholders: Impact-oriented businesses in emerging markets and communities around them

Impact metrics and outcomes

Impact metrics: Reported at fund-level and borrower level with impact assessment on five metrics, reported yearly by borrower companies.

- Job creation: Around 10,000 in 2019 (permanent employees reported by each borrower)

- Female employees: 3,400

- Employees trained: Around 8,000

- Wage growth: 156% wage growth across portfolio companies

- Increased revenues: 223% revenue increase

- Increased taxes to local governments: 333% tax payments increase

- Increased net profits: 27% net profit increase

Borrowers also report on their contribution towards the Sustainable Development Goals (SDGs)

Portfolio investee spotlights

Grain processor, Uganda

TGSIF provided USD 5 million of term loans to a leading grain and oilseed aggregator and distributor in Uganda, sourcing products from smallholder farmers through 60 collection centres

The loans were used to purchase and convert land into a rainfed maize and soybean farm and to launch a farming operations and smallholder farmer trainings on improved agricultural yields and productivity

By 2019, 24,000 metric tons of grains were harvested and sold

Mobile phone distribution, India

TGSIF provided USD 15 million in trade finance loans to a low-cost mobile phone company based in Hong Kong and its Indian trading partners to import and distribute the technology across India

The financing also covered the development of a computer education centre in West Bengal to address the digital divide and support the use of technology in education

Institutional investor spotlight: Christian Super

Investment: Around USD 150 million

Christian Super is an Australian superannuation fund with over USD 1.3 billion in AUM, which makes investments based on biblical values. The portfolio includes investments in financial inclusion, renewable energy and healthcare amongst others, pursuing social impact alongside strong financial returns.

Christian Super committed an initial investment of USD 100 million to TGSIF, supplemented by an additional investment of USD 50 million in 2017.

“Christian Super is excited to be partnered with TriLinc in such a values aligned investment opportunity, TriLinc’s embracing view of impact investment is a great model of the future of global investment encompassing a broader focus than just financial metrics.”

Tim Macready, Chief Investment Officer, Christian Super

Other similar opportunities in the market

- There is still a significant market gap for financing the “missing middle” of SMEs in Sub-Saharan Africa, estimated between USD 90 and 120 billion

- The African Development Bank Group (AfDB) has set up a large trade finance programme to catalyse the trade finance community to overcome challenges and increase investments

- As part of its Risk Participation Agreement, AfDB shares the credit risk (usually up to 50%) of a portfolio of eligible trade transactions

- AfDB also supports local financing situations by providing trade finance solutions through its Trade Finance Line of Credit and directly finances export marketing of agricultural commodities across the region

Key observations for institutional investors

Trade finance offers relatively safe, liquid means of accessing emerging markets

- Trade finance loans are typically short in duration, starting from tenors of 15 days to a maximum of six months, allowing the fund to make regular distributions to investors as loans come to term

- Loans are repeated to customers with good track records, building a positive credit history, which helps de-risk the investments

Global diversification helps to reduce risks

- A widely diversified portfolio, in terms of region, country and sector of investments helps to reduce the risk of market shocks affecting businesses’ ability to repay their financing loans or other significant downturns

- ā Nevertheless, global economic downturns such as the COVID-19 pandemic can significantly reduce trade flows globally, which may affect cash flow in markets around the world

Track records demonstrate emerging markets investment viability

- An established fund track record demonstrates the viability of impact investments in emerging markets, building confidence in future investment opportunities

- EAIF has only experienced two debt writedowns over more than 70 projects across 22 countries over a 16-year history

Trade finance helps to connect lower income areas to local, regional and global value chains, enhancing value

- From an impact perspective, trade finance helps improve cash flow in value chains, allowing businesses to increase their turnover and revenues and overcome entry barriers they face in entering larger, more profitable markets

- It also helps to mitigate the risks of companies not receiving timely payments

Sources:

Sources: i) AfDB, “Trade Finance in Africa: Overcoming the Challenges” (2017) ii) TriLinc Global Press Release: “Christian Super Provides Leverage to TriLinc for Global Impact Investments” (2017) iii) Mbuyu Capital “Trade Finance in Frontier and Emerging Market” (2018)