Ambition:

LeapFrog aims to achieve ‘Profit with Purpose’, combining outstanding financial returns and outsized impact

• Climate and Environmental Action: Drive adoption of clean technologies through financial inclusion with enhanced ESG reporting

• Socio-economic Distribution and Equity: LeapFrog helps deliver underserved consumers with access to the springboards and safety nets that provide the opportunity and pathway out of poverty, focusing on essential products and services in financial services and healthcare

• Community Voice: LeapFrog supports customer-centric businesses that design products/services around the essential needs of emerging consumers

Description of the fund

The LeapFrog Emerging Consumer Fund III, LP (2017) is a $743 million fund offering exposure to high quality financial services and healthcare businesses across Asia and Africa.

The fund aims to invest in businesses that provide quality, relevant and affordable products to the two billion (and rising) underserved emerging consumers, living on less than $10 a day.

By June 2021, the fund had reached 93 million people after four years, surpassing the 70 million target for the full life of the fund.

Manager

LeapFrog Investments was founded in 2007 and has raised $2 billion across its funds.

The manager operates from 8 offices with 70+ professionals.

LeapFrog’s investee companies now reach 227 million people across 35 countries with healthcare or financial services.

They have also grown at 25% annually, on average, from the time of investment.

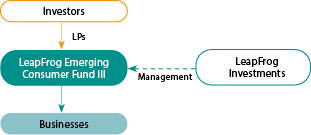

Investors

The fund is backed by 50 limited partners (LPs) including insurers (including Prudential Financial and AIG), other institutional investors (including Morgan Stanley and Nuveen), DFI/MDBs (including CDC, IFC and EIB) and many foundations/endowments (including Ford Foundation and Rockefeller Foundation).

Key attraction points for institutional investors

- Market rate returns and track record; combined with

- Strong social impact

Key Terms

Fund level

- Vehicle / fund type: Close-end private equity fund

- Fund size: $743 million (original target of $600 million)

- Blending and/or TA: No blending, some initiatives with portfolio companies are funded by technical assistance grants

- Sponsor/anchor: None

- Term/investment period: 10 years / 5 years

- Target return: Confidential, hurdle rate 8%

- Management fee/incentive fee: 2%

- Vintage (first close): 2017

- Co-investment rights: yes

Investee level (investment strategy)

- Instrument(s): Equity

- Target investee type(s): Growth stage companies in emerging markets

- Target sector(s): Financial services and healthcare

- Target geographies: Africa and emerging Asia

- Investment tenor: 3-7 years

- Average ticket size: $20-75 million

- Investment currency: Local currency or USD

Pipeline and portfolio

Market opportunity

The Problem: By 2030, there will be 4 billion emerging consumers with small and irregular income flows, making it difficult to save to withstand adverse events. Even families with savings may fall back into poverty after an income-earner dies or a productive asset is lost. At the same time, these consumers are seeking springboards out of poverty through access to financial services like business loans and housing finance.

The Opportunity: LeapFrog invests in innovative companies that seek to break this cycle by offering affordable, relevant and high-quality products, often through new technology distribution channels. When these purpose-driven businesses are able to attract high quality staff, are customer-centred and have better relationships with key stakeholder networks, they exhibit lower levels of risk and greater growth potential creating both outsized impact and returns. This is the essence of the ‘Profit with Purpose’ strategy.

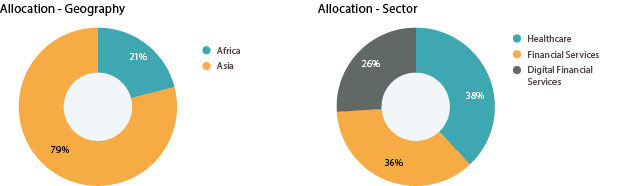

Allocation

Just Transition in the investment process

- LeapFrog operates solely in emerging markets and only sources investment opportunities that clearly support low-incomes consumers, resilient communities and strong ESG principles

- ESG and impact due diligence are conducted prior to investment, and are critical to Investment Committee approval. This includes ESG scoring, analysis of emerging consumer reach, articulation of clear theory of change and support for SDG goals

Structure and risks

Legal Structure

Jurisdiction: Mauritius

Legal form: Limited partnership

Capital structure: Partnership interests

Key risks

| Key risks | Mitigant(s) |

|---|---|

| Geographic | Strong technical depth in healthcare and financial services drives focus on resilient, high-growth businesses |

| Currency | Portfolio, diversified across Africa and emerging Asia |

| Political | Investments supported by multiple regional offices and in-country experts |

Outcomes framework

Climate and social metrics

Examples include:

- Climate and Environmental Action: Exclusion list applies

- Socio-economic Distribution and Equity: People reached (including low-income populations), quality of products, affordability for low-income consumers and relevance to meeting the customer need, job creation and gender equality metrics. In addition, sector-specific metrics (financial services and healthcare)

- Community Voice: Customer experience and satisfaction using renewal ratios, repeat clients and direct customer interviews, adapted for each sector

Framework and reporting

LeapFrog has a proprietary impact measurement framework: Financial Performance, Impact, Innovation, Risk Management (FIIRM).

- Reporting standard: informed by the IMP; aligned to the Operating Principles for Impact Management

- Transparency: Details about the FIIRM and impact results are available on the LeapFrog website

- Third-party verification: Yes; audit of the impact against the Operating Principles for Impact Management

Select areas of Just Transition enhancement

- Is there an opportunity to further the current climate and environmental linkage of the fund, from both within the energy investments and across sectors, and build other climate and environmental action aspects into the fund strategy that could be included in the metrics?

- Could the fund expand its ambition statement to include targets for all three Elements of the Just Transition?

Investee in the spotlight

Investing in CarDekho

Background

For many millions of emerging consumers, mobility is the key that unlocks opportunity – it dramatically increases school enrolments, improves access to healthcare, broadens employment opportunities, and is a major source of direct employment for many emerging consumers. In a recent study, 50% of women in Chennai, India, reported being sexually harassed whilst travelling on public transport. In Bangladesh the number is as high as 84%.

CarDekho is a leading auto-tech and mobility financing company in India, operating auto sales, classifieds, finance, and insurance businesses. It serves 3.6 million emerging consumers, and 86% of Indian purchasers will visit the platform before buying a vehicle. These low-income consumers are dramatically underserved. For instance, used car loan penetration is 17% in India, compared to developed markets where penetration is 75%.

CarDekho not only improves access to vehicle insurance and finance, but also has made a concerted effort to improve the quality of vehicles sold on its platform. It provides documentation on each vehicle that validates ownership and accident history, as well as promotes new and affordable electric vehicles (EVs), like those produced by Mumbai-based startup Strom Motors and existing manufacturers like Tata, some of which retail for as little as $6,000. CarDekho will be an important platform in enabling India’s transition to EVs. In Q1 FY22, there were more than 3m searches for EVs on CarDekho’s sites.

Investment

LeapFrog led a $250 million capital raising round in October 2021.*

Impact

LeapFrog believes that balancing access to mobility with improvements in transport safety and environmental impact is key to delivering an overall improved quality of life to emerging consumers.

Climate and Environmental Action: LeapFrog will work with CarDekho on environmental programmes across its platform, and to track and target key impact data, as well as help catalyse an upgrade of existing vehicle fleets to EVs.

Socio-economic Distribution and Equity: LeapFrog’s customer experience (CX) experts plan to support CarDekho to grow across low-income consumers seeking access to their first vehicle or to upgrade their existing vehicle. For instance, CarDekho has the opportunity to expand used vehicle finance products, which offer low-income consumers access to more affordable vehicles, but which banks typically eschew. LeapFrog will support efforts by CarDekho to enhance diversity and inclusion.

Community Voice: Customer experience and satisfaction using renewal ratios, repeat clients and direct customer interviews.

Sources:

Thynell, Marie (2017): “Roads to Equal Access: The Role of Transport in Transforming Mobility.” Transport and Communications Bulletin for Asia and the Pacific No 87; Dipu, Tahmina Akter and Nasratul Ferdous (2019): “A study of Women Harassment in public transports in Bangladesh.” International Journal of Science and Business Vol 3(6).

*This deal is subject to closing in accordance with the transaction terms.