Ambition:

The fund targets companies providing solutions to households without access to electricity and businesses looking for cleaner, cheaper and more reliable energy. Beyond financing the off-grid sector, it actively addresses the solar potential for the commercial and industrial (C&I) sector.

• Climate and Environmental Action: Reduce CO2 emissions by 6m tonnes, 2,800 GWh of clean energy generated, 2,000 MW renewable energy capacity*

• Socio-economic Distribution and Equity: Access to energy for 170 million people, 5,200 SMEs with improved access to electricity, 5,750 new full-time jobs, 37 million products sold by portfolio companies, all by the end of fund life

• Community Voice: Data from initiatives such as GOGLA, of which responsAbility is an active member, contributes to understanding and monitoring the impact of the fund in the local communities across the full range of positive social benefits of improved energy access and reliable electricity supply

* by end of fund life

Description of the fund

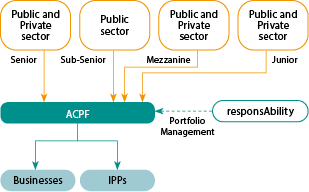

responsAbility’s Access to Clean Power Fund provides senior and mezzanine debt to companies that provide access to energy solutions to households and SMEs, including C&I.

Strong focus on Sub-Saharan Africa and South and Southeast Asia.

Manager

Founded in 2003, responsAbility has $3.5 billion in AUM across 90 emerging economies, with over $11 billion invested since inception; 85% of AUM in debt financing.

Headquartered in Zurich, the manager has seven further offices and 148 investment professionals.

Dedicated impact manager, investing for a sustainable world, with a focus on climate finance, financial inclusion and sustainable food.

Investors

DFIs: EIB, FMO, the government of Luxembourg, IFC, Norfund, OeEB, SECO, USAID.

Foundations: Shell Foundation, Swift Foundation, Lundin Foundation.

Institutionals: AHL Venture Partners, Ashden Trust, Bank of America, Calvert Impact Capital, Clean Technology Fund, Snowball.

Key attraction points for institutional investors

Attractive investment topic with large unmet demand and continuous high growth; de-risking mechanism through blended structure.

Key challenges for institutional investors

Long-term closed-ended fund (10 years).

Key Terms

Fund level

- Vehicle/fund type: Closed-end private debt fund

- Fund size: Actual $158 million (final closing December 2020)

- Blending and/or TA: Yes; four layers of capital plus TA facility

- Sponsor/anchor: IFC, FMO, Lundin Foundation, Shell Foundation, responsAbility

- Term/investment period: 10 years / 3 years

- Target return: Confidential

- Management fee/incentive fee: Confidential

- Vintage (first close): 2019

- Co-investment rights: Yes

Investee level (investment strategy)

- Instrument(s): Senior and mezzanine debt

- Target investee type(s): Growth/mature off-grid enterprises (SHS, C&I)

- Target sector(s): Energy access companies (SHS), C&I, and opportunistically energy value chain enterprises

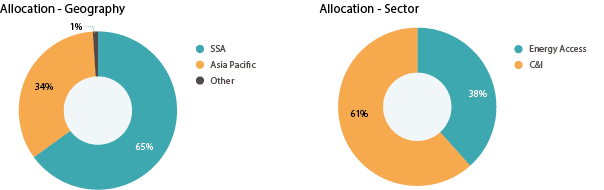

- Target geography(ies): Focus on SSA, SA and SEA

- Investment tenor: 2-3 years for inventory/receivables backed loans, 5-10 years for Independent Power Producers (IPPs), maximum 10 years

- Average ticket size: $3-10 million

- Investment currency: Primarily USD; local currencies selectively

Pipeline and portfolio

Market opportunity

The Problem: Access to energy is a key driver of economic growth, yet many emerging market countries still face significant challenges in power generation and distribution, resulting in over one billion people without access to electricity. Sub-Saharan Africa lags the most, accounting for three- quarters (570 million) of people globally without electricity access. Although access in urban areas of Sub-Saharan Africa reached 78% by 2019, access in rural areas was only 25%.

The Opportunity: According to the International Energy Agency (IEA), providing electricity for all by 2030 would require an annual investment of $52 billion per year, more than double the current level being mobilised. The fund leverages on responsAbility’s capabilities and track record in energy debt where it has a portfolio of over $800 million since 2014. Specifically, aiming to focus on the Energy Access and Distributed Generation space, where it has disbursed over $150 million in the past five years with more than 10 investees in Africa and Asia.

Pipeline: C&I in Nigeria, Maldives, India, South Africa and Vietnam; energy access in Kenya, Rwanda, DRC and Togo.

Allocation

Just transition in the investment process

- Due to local market presence, the fund has an up-to- date view on needs and opportunities, using on-site due diligence visits and interviews, engaging internal and external experts thus allowing the team to identify needs

- The fund screens for a commitment to environmentally and socially sound business practices; owner and management integrity; contribution to the SDGs; fair client treatment and expected climate outcomes

Structure & risks

Legal Structure

Jurisdiction: Luxembourg

Legal form: SICAV-SIF

Capital structure: four layers

Key risks

| Key risks | Mitigant(s) |

|---|---|

| Geographic | Highly diversified portfolio; geographical allocation limits: Africa: <70%, Asia: <70%, Latin America: <20%; single country: <20% (<30% for India and Kenya) |

| Currency | 100% of principal of loans is hedged; current allocation: 68% USD, 31% INR hedged, 1% EUR hedged |

| Concentration | Sectors limits (direct): Energy access: <60%, C&I: <70%, value chain players: <25%, financial intermediaries: 0% (excluding existing EAF investments) Product limits: Senior secured debt: >70%, senior unsecured debt: <30%, mezzanine debt: <20%, equity: 0% (excluding investments into hedging counterparties) |

Outcomes framework

Climate and social metrics

- Climate and Environmental Action: CO2 lifetime savings, capacity of renewable energy installed, black carbon avoided

- Socio-economic Distribution and Equity: Number of people with access to clean energy, number of products sold, number of jobs created by gender, number of management jobs and board seats by gender, increased economic activity, cost reduction for small businesses, increased opportunities for women

- Community Voice: GOGLA feedback reports

Framework and reporting

Underlying reporting standards: IRIS+, GOGLA, 2X

Transparency: Annual E&S and Impact report for investors, quarterly report for investors

• Third-party verification: No

Select areas of Just Transition enhancement

- Could investees be vetted on their community engagement, and could investments that show strong engagement be prioritised?

- Could the fund encourage investees to integrate customer feedback loops to ensure a community-centric approach?

Investee in the spotlight

Investing in d.light

Background

Established in 2007, d.light is a global leader and pioneer in delivering affordable solar-powered solutions designed for the two billion people in the developing world without access to reliable energy. d.light provides distributed solar energy solutions for households and small businesses that are transforming the way people live all over the world. It sells its products on credit using a Pay As You Go (PAYGo) business model.

Through four hubs in Africa, China, South Asia and the United States, the company has sold over 20 million solar light and power products in 70 countries, improving the lives of over 100 million people. d.light is dedicated to providing the most reliable, affordable and accessible solar lighting and power systems for the developing world.

Geographical area: With a focus on East Africa and India, d.light covers Kenya, Uganda, Tanzania, Nigeria, Zambia, DRC and India.

Investment

$8.5 million senior secured loan.

Impact

Climate and Environmental Action: 2.2t CO2 lifetime savings.*

Socio-economic Distribution and Equity: 23 million additional people with access to clean power, 850 quality jobs created in 2019, 30% of which are held by women.

Community Voice: d.light uses sales data, customer feedback and ongoing product evaluation in the field. This provides a comprehensive picture of how access to energy transforms customers’ lives.**

Sources:

* Excluding black carbon emissions

** d.light website: “Out Impact”; https://www.dlight.com/social-impact