We’re starting The Resilience Conversation to explore that question and to examine whether impact investing can help strengthen portfolios today and prepare them for tomorrow’s challenges.

Watch the launch video below

Why we’re starting this conversation

In 2024, the Impact Investing Institute launched an ambitious initiative to transform how the $98 trillion global investment market approaches impact investing.

At the Impact Investing Institute, we work closely with pension funds, insurers and asset managers who are navigating rapid and structural shifts – from the energy transition to demographic change to the growing need for inclusive growth.

These forces are reshaping markets. And more investors are exploring whether allocating to impact can support portfolio resilience in the face of long-term change.

This campaign aims to surface that thinking, share practical insights, and invite the wider market to reflect on what long-term resilience means today.

Our starting point

Impact investing can drive long-term resilience.

Early signals suggest that:

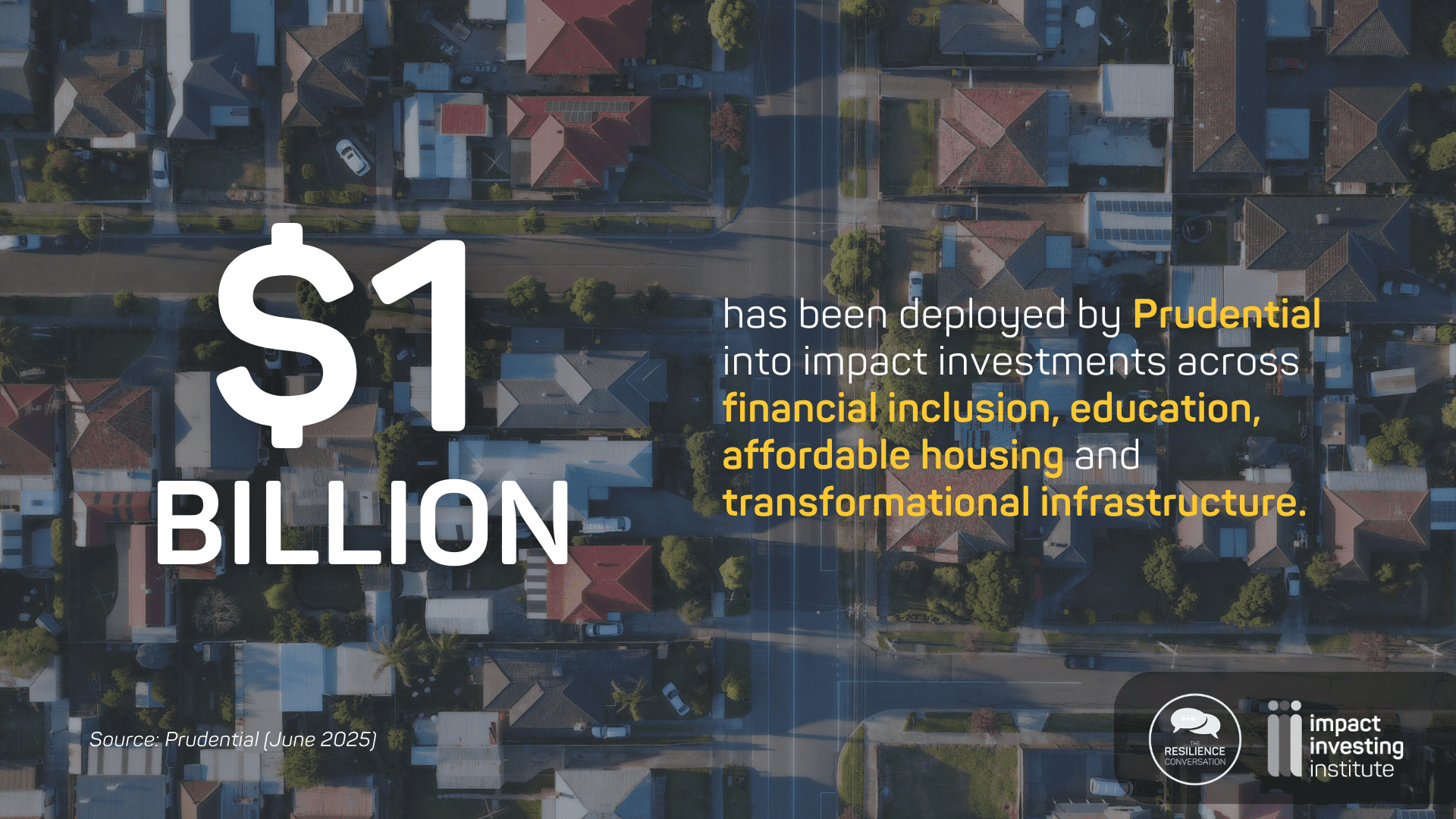

1. Credible investors are already investing in impact.

Pension funds, insurers and other respected investors are investing in impact, signalling growing recognition of its critical role in an investment strategy.

2. Impact investments align with wider market direction.

Impact investing responds to major economic, social and environmental shifts – contributing solutions to the energy transition, demographic change and inclusion – positioning investors to get in early on long-term trends.

3. Impact investing can strengthen portfolios and help manage risk in volatile markets.

Businesses driven by answering long-term social and environmental needs often respond differently to market swings: impact strategies can answer a range of institutional portfolio needs – such as diversification and risk management.

These are the ideas we will be exploring through The Resilience Conversation.

Join The Resilience Conversation

Over the coming months, we’ll share perspectives from investors and experts who are redefining what resilience looks like in practice.

We invite you to follow along – and share what a resilient portfolio means to you. Get in touch today.

Data Spotlight

The Resilience Brief

A growing number of pension funds, insurers and others are discovering that assets designed to do good in the world may also be the best way to ensure the long-term strength of their portfolios.

Helpful Guides

The Impact Investing Principles for Pensions provide an accessible, practical insight into the opportunity presented by impact investing and concrete steps pension scheme trustees (and others managing pension schemes) can take to embark upon impact investing.

Our impact investing market report estimates the size and the features of the UK impact investing market in 2024. It is based on a comprehensive investor survey and engagement with over 100 market actors, thought leaders, and policy makers, and updates our inaugural market sizing report, published in 2022.

Coming soon on this page:

- Interviews with experts and investors

- A visual snapshot of institutional investor commitments to impact

- Additional insights as the conversation evolves