Mobilising institutional capital to deliver a Net Zero world where no-one is left behind.

Reducing and absorbing carbon emissions at the speed and scale needed to safeguard our planet requires vast amounts of capital. The global costs required to achieve ‘Net Zero’ carbon emissions have been variously put at $1.6 trillion [1] to $4 trillion a year [2]. Governments and the public sector alone cannot meet these huge capital requirements. More of the $154 trillion [3] held globally in private pensions, insurance policies, endowments and other institutional arrangements urgently needs to be deployed in investments that can help drive a global transition to Net Zero.

At the same time a global consensus is emerging that to be sustained and successful, this transition needs to be socially inclusive. Capital will need to be invested in ways that support a Just Transition towards a Net Zero world that is fair and beneficial for all – including the delivery of the United Nations’ Sustainable Development Goals (SDGs).

Aren’t lots of private investments already seeking to have a positive impact?

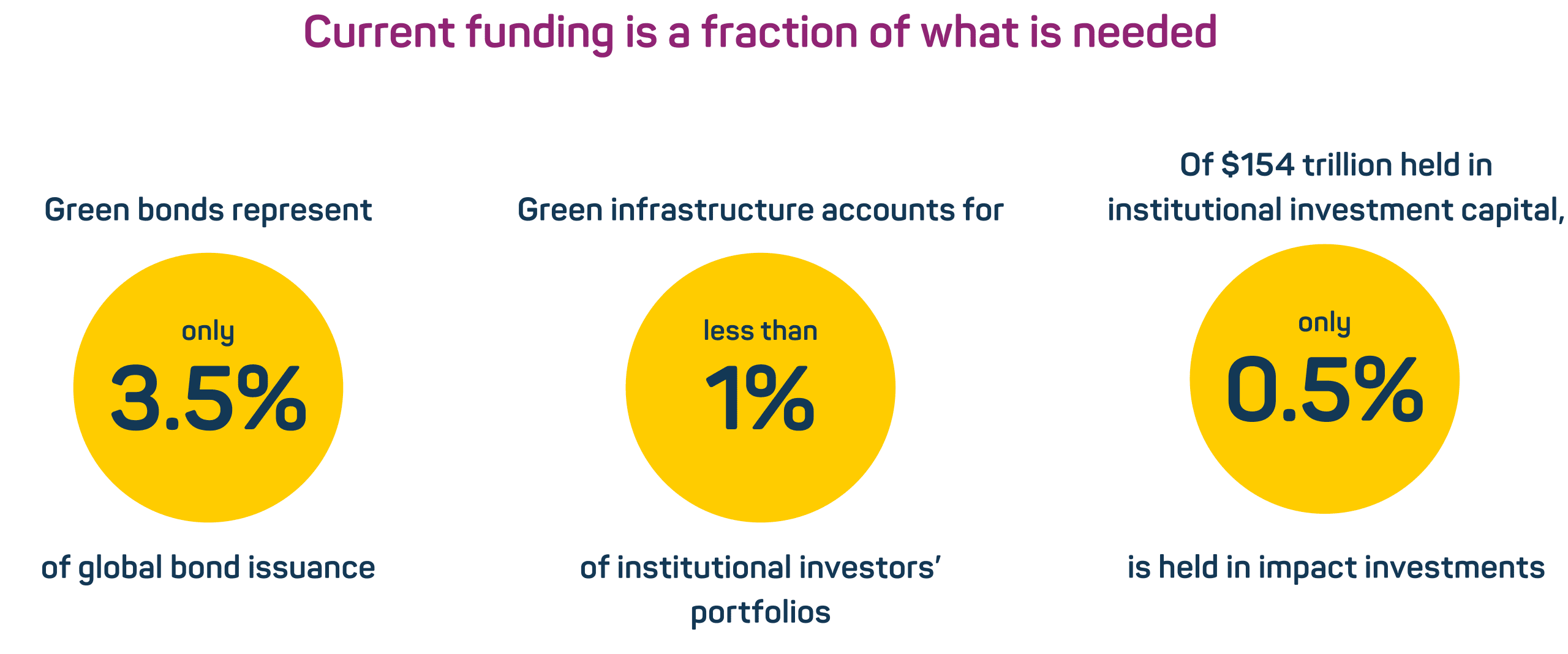

The resources available within financial markets to address the climate and social challenges that the world faces are immense. Investment that takes environmental, social and governance (ESG) factors into account has been expanding over the past decade to embrace ‘responsible’, ‘sustainable’ and ‘impact’ investing. Yet the bulk of private capital still sits on the sidelines of the most pressing issues of our day.

All actors – detailed below – need to work together to effect systemic change to expand and accelerate the flow of capital urgently to where it is most needed.

Does it make sound investment sense?

Deploying capital to address the SDGs and deliver a Just Transition is not only a social and moral imperative. It also makes strong investment and economic sense, as illustrated by examples from across the globe:

- At a global level, analysis suggests that bold action on climate change could yield a direct economic gain of $26 trillion through to 2030 compared with business-as-usual [7]

- In the UK, the Climate Change Committee estimates that major operating cost savings would more than offset the multi-billion pound capital costs of Net Zero investments up to 2035 – and that the level of UK GDP could be around 2% higher as resources are redirected from fossil fuel imports to UK [8]

- In South Africa, investments built around renewable energy, sustainable transport solutions and nature-based rehabilitation have been projected to deliver 250% more jobs and 420% more value added in the economy compared to traditional fossil fuel investments.

Just as important, capital that ignores environmental and social challenges will be increasingly vulnerable to performance as well as reputational risk.

What is needed to mobilise more capital for the SDGs and a Just Transition today?

As part of the UK’s presidency of the G7 in 2021, the Impact Taskforce was mandated to develop actionable pathways for mobilising greater amounts of capital to invest in solutions to help meet the long-term needs of people and the planet [9].

The Impact Taskforce’s report, ‘Mobilising institutional capital towards the SDGs and a Just Transition’, presents these pathways. The report was produced by the Impact Taskforce’s workstream on instruments and policies for financing the SDGs and a Just Transition. It is based on engagement with 170 influential stakeholders representing over 110 organisations based in almost 40 countries.

The Taskforce’s investment, policy and thought leaders issue the following priority areas for action:

What specific actions do different parties need to take now?

All parties in financial markets have responsibility to take action now to help mobilise institutional capital to advance a Just Transition. No matter their starting point, each actor can and should do more to participate in the solutions that will build a more sustainable and inclusive world for all.

The Impact Taskforce identifies priority actions for eight key audiences. The links below provide full summaries of recommended actions for each audience.

Case studies of Just Transition financing instruments across asset classes

For more information about our work on Just Transition Finance, visit our dedicated project page.

[1] Energy Transitions Commission (2020): “Making Mission Possible – Delivering a Net-Zero Economy”;

[2] IEA (2021): “Net Zero by 2050 – a Roadmap for the Global Energy Sector”;

[3] Thinking Ahead Institute (2021): “Global Pensions Asset Study – 2021”; The analysis includes pension funds, insurance companies, sovereign wealth funds, endowments and foundations, and mutual funds.

[4] BIS (2020): “Quarterly review – green bonds and carbon emissions: exploring the case for a rating system at the firm level”;

[5] Figure excludes direct investment in corporate stocks. OECD (2020): “Green Infrastructure in the Decade for Delivery : Assessing Institutional Investment”;

[6] Based on $715bn held in impact investments in 2020. GIIN (2020): “2020 annual impact investor survey”;

[7] The new climate economy (2019): “Unlocking the inclusive growth story of the 21st century: Accelerating climate action in urgent times”;

[8] CCC (2020): “Sixth Carbon Budget”;

[9] The Impact Taskforce was supported by the Global Steering Group for Impact Investment and the Impact Investing Institute.