This guide, produced with support from Schroders, provides first-of-its-kind insight into the state of the UK’s wealth management impact offering, the challenges to unlocking greater levels of adoption and how leaders in the space have overcome these hurdles to build successful impact propositions.

Wealth managers are in a privileged position, acting as long-term financial stewards, often building trusted, multi-generational relationships. This makes them key gatekeepers, enablers and influencers for wealth holders looking to align their capital with their values. In a world facing many urgent challenges, investment clients of all kinds are seeking more purposeful approaches to managing and building their wealth.

However, this growing base of investors is not always being served effectively. Their purpose-driven capital therefore risks being under-allocated to the causes it is intended for, at a time when there is a pressing need to help fund the environmental and social solutions of the future.

Crucially, through this misalignment, wealth managers are missing out on a long-term commercial opportunity to help future-proof their business.

Drawing on interviews and surveys with wealth management professionals, as well as four case studies of investor practice, this guide shows how the sector is thinking about impact investing, details the experiences and learning of impact wealth management pioneers – from boutiques to global businesses – and provides a practical roadmap for those seeking to establish or further develop an impact offering of their own.

Compelling business case

At a time when wealth management firms are facing increasing pressure on fees, an industry focus on scale, and regulatory expectation to demonstrate their value, impact investing can offer a powerful means to attract clients and stand apart in a crowded market.

The case for impact investing spans:

Client attraction and retention: Impact investing can be a valuable tool for both: client acquisition, with 86% of survey respondents reporting an increase in interest in sustainable and impact investments between 2020 and 2025; and retention, with firms reporting that once impact clients join, “they tend to stay”. Values-led clients are open to higher fees: a 2023 EY study found that 74% of wealth management clients would pay a premium for personalised services that reflect their values. With the great generational wealth transfer that is expected to see £5.5 trillion passed between generations in the UK by 2047, impact investing also helps to retain clients across generations: this is particularly important when research shows that over 80% of heirs look for a new adviser upon inheriting wealth.

Differentiation: In a consolidating wealth management sector, where investment solutions are being centralised and homogenised, impact investing can give firms a meaningful way to differentiate themselves. Our survey found that 76% of wealth management professionals gagreed that a dedicated impact offering could be a valuable unique selling proposition, yet less than half of those saying so have a dedicated offering today – revealing a substantial opportunity for those that act now.

Easier market entrance: Impact investing is easier than ever to access: at US$1.571 trillion globally and £76.8 billion in the UK, the impact investment market is broad and mature, offering a range of opportunities and entry points. Product innovation, greater access to impact opportunities in private market assets, and regulatory support, such as the FCA’s new Sustainability Impact label for funds, are all making it easier for firms to create impact offerings.

Opportunities for all firm sizes: While larger firms have scope to create the most comprehensive impact investing offerings, third-party impact solutions mean smaller firms can also build impact propositions successfully. Some small boutique firms specialise exclusively in impact, giving them an edge despite their size.

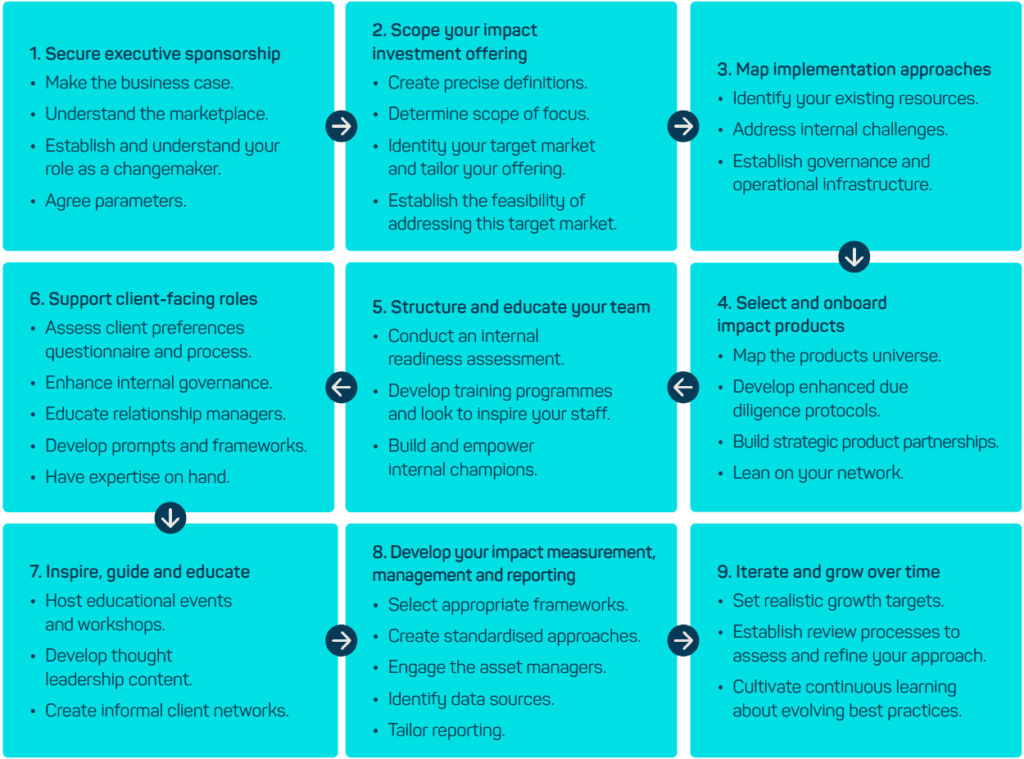

Roadmap to build, implement and grow an impact offering

Although every firm’s journey will be unique, we have identified common steps for creating a robust impact investment proposition.

Proven solutions to commonly cited challenges

Developing an impact offering takes time and constant iteration, and firms may encounter challenges along the way. Commonly cited challenges include client awareness, perceptions of financial performance, product issues and operational barriers – but all of these have solutions.

If firms are not seeing the same demand from their own clients that wider market surveys depict, the issue is often not that clients aren’t interested in supporting positive social and environmental outcomes, but that they don’t know enough about how impact investing can help address them – education can untap latent demand.

Client concerns that impact investing won’t deliver the financial returns they need can be addressed by highlighting research that demonstrates impact investors widely targeting and achieving market-rate returns.

Lack of existing operational expertise and resources to deliver impact investing can be improved through building institutional backing, educating staff and exploring guidance from organisations such as the Global Impact Investing Network and the Impact Investing Institute.

Early-mover advantage

Impact-focused wealth management is at an early stage of growth. While 85% of our survey respondents have a sustainable investment offering, only 33% provide an impact offering. With sustainable investment now part of the mainstream, impact investment offers a compelling early-mover advantage to firms that can bring together the governance, teams and products to meet demand successfully.