The world is changing, with new challenges for people and the planet. Pensions are vulnerable to these challenges, but they also have the power to contribute to solutions to the most pressing environmental and social problems we face.

So, what is standing in the way?

There are some common myths about the compatibility of impact investing with pension funds’ fiduciary duty, the legal obligation on trustees to act in the best interest of the scheme’s members. Some people understand this duty to be synonymous with maximising short-term financial return, some people think that impact investing means you have to sacrifice a financial return.

We are here to bust these myths by providing reliable, practical information and helping people to share their experiences. We want to make it easier for pension schemes to navigate their responsibilities with regards to sustainability and to choose to contribute to building a better, more sustainable world.

What have we done about it?

Pensions investing with impact: Impact Investing Principles for Pension Trustees

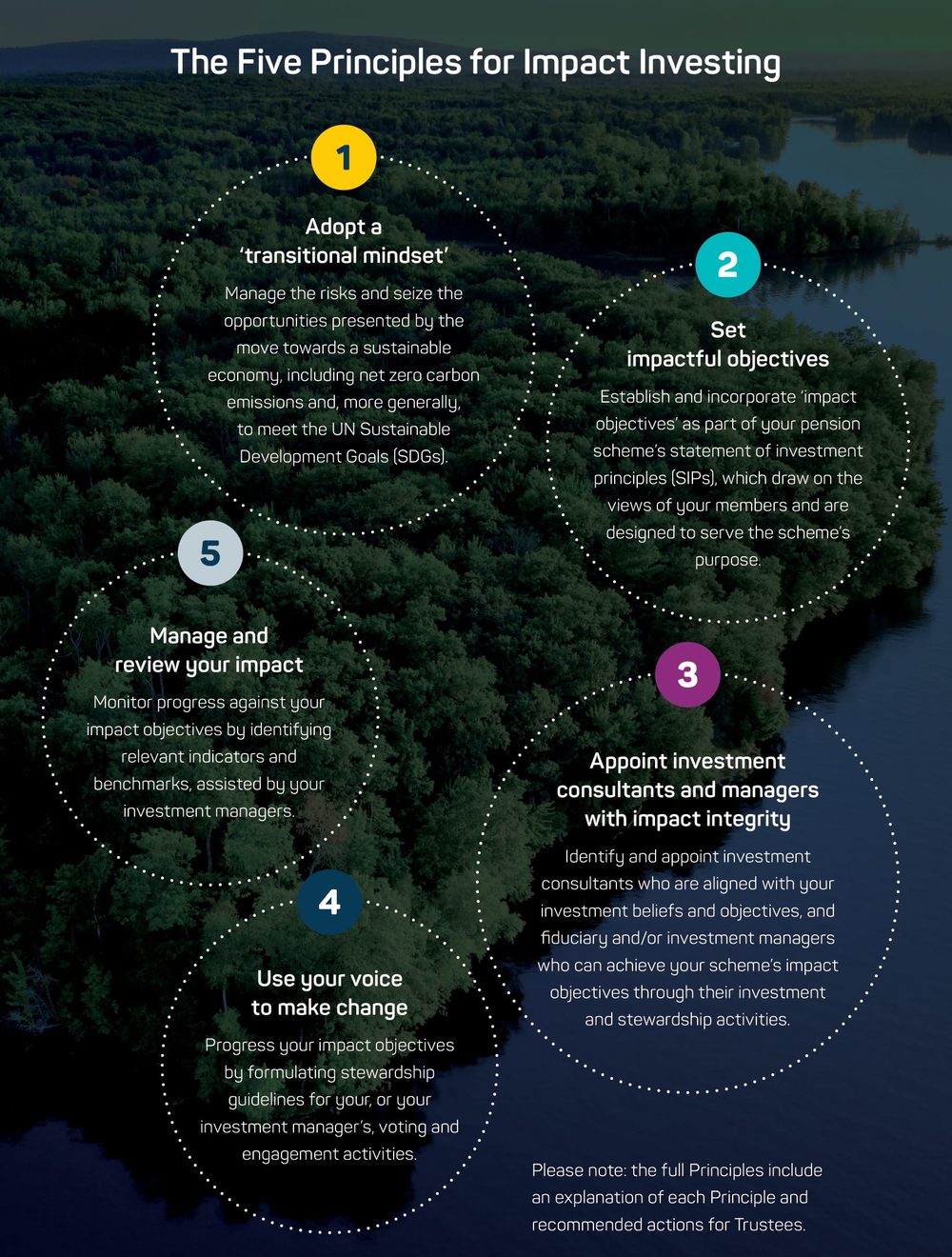

We developed five guiding principles for pension trustees that give an accessible, practical insight into the opportunity presented by impact investing and the concrete steps trustees can take to pursue an impact investing strategy.

To download the full principles, please click here.

Clarification of trustees’ fiduciary duty and impact investing

We have produced an explanation of fiduciary duty and impact investing, written and attested by five leading pension law firms. We focus on dispelling the myths that impact investing is not compatible with pension funds’ fiduciary duty and that impact investing requires pension funds to accept below market returns. The paper is being reviewed by a number of other lawyers before publication in November, but do contact us at pensions[at]impactinvest.org.uk if you would like to see a draft.

What can you do?

We need your feedback. We want our work to help pension funds and their third-party advisers understand and do impact investing. You can help us by:

Responding to our short survey to let us know your thoughts about our Impact Investing Principles.

Becoming an ‘early adopter’ – commit to using the Impact Investing Principles, share them with your peers and join our growing impact investing network.

Sharing your experiences – we want to hear from you and help spread the knowledge. Do you have any successes or challenges around impact investing which you would like to share with us? Email pensions[at]impactinvest.org.uk