More pension money to be invested for people and the planet

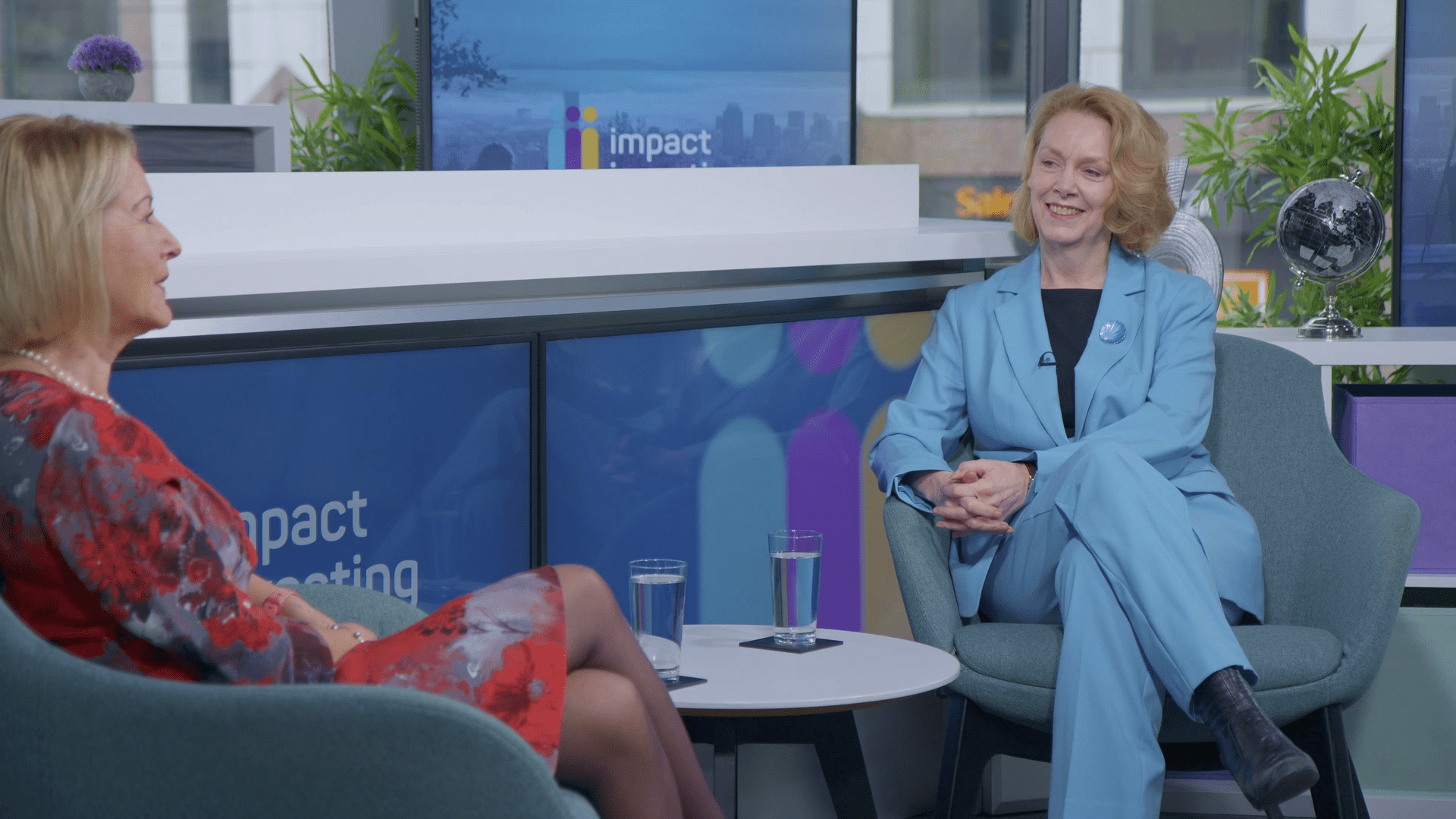

We work with pension funds, pension consultants, asset managers, policymakers, lawyers, and industry experts to see how more of the funds that are being invested for people’s retirement can also be invested for social and environmental impact.

Fiduciary duty

We advocate for clarification of fiduciary duties – the legal obligation of pension trustees to act in the best interest of pension scheme members – to include consideration of social and environmental impact as well as financial return.

This has included a legal research paper, co-written by five leading law firms, explaining how fiduciary duties and impact investing are compatible.

Impact Investing Principles for Pensions

The Impact Investing Principles for Pensions provide an accessible, practical insight into the opportunity presented by impact investing and concrete steps pension scheme trustees (and others managing pension schemes) can take to begin impact investing.

Developed originally by the Impact Investing Institute and Pensions for Purpose in 2020, the May 2025 update includes The Global Impact Investing Network (GIIN)’s significant contribution and endorsement to reflect:

- the changing landscape of impact investing;

- evolving legal and regulatory realities which pension schemes operate under;

- lessons from five years of market experience.

Impact investment through these principles is aligned with fiduciary responsibilities. Investing in positive social and environmental solutions, aimed at improving pension members’ standard of living, fostering a sustainable living environment or aligning with their beliefs adds a distinct extra value dimension alongside financial returns.