-

Bridging the gap: how impact investing can become more inclusive

Read more about this: Bridging the gap: how impact investing can become more inclusiveWe look at how impact investing can become more inclusive and how charitable foundations can be part of that journey through the way they invest their endowments.

-

Launching our five-year strategy under an evolved leadership

Read more about this: Launching our five-year strategy under an evolved leadershipWe are pleased to announce an evolution of our leadership to deliver our ambitious and exciting five-year strategy, developed by the Board and team.

-

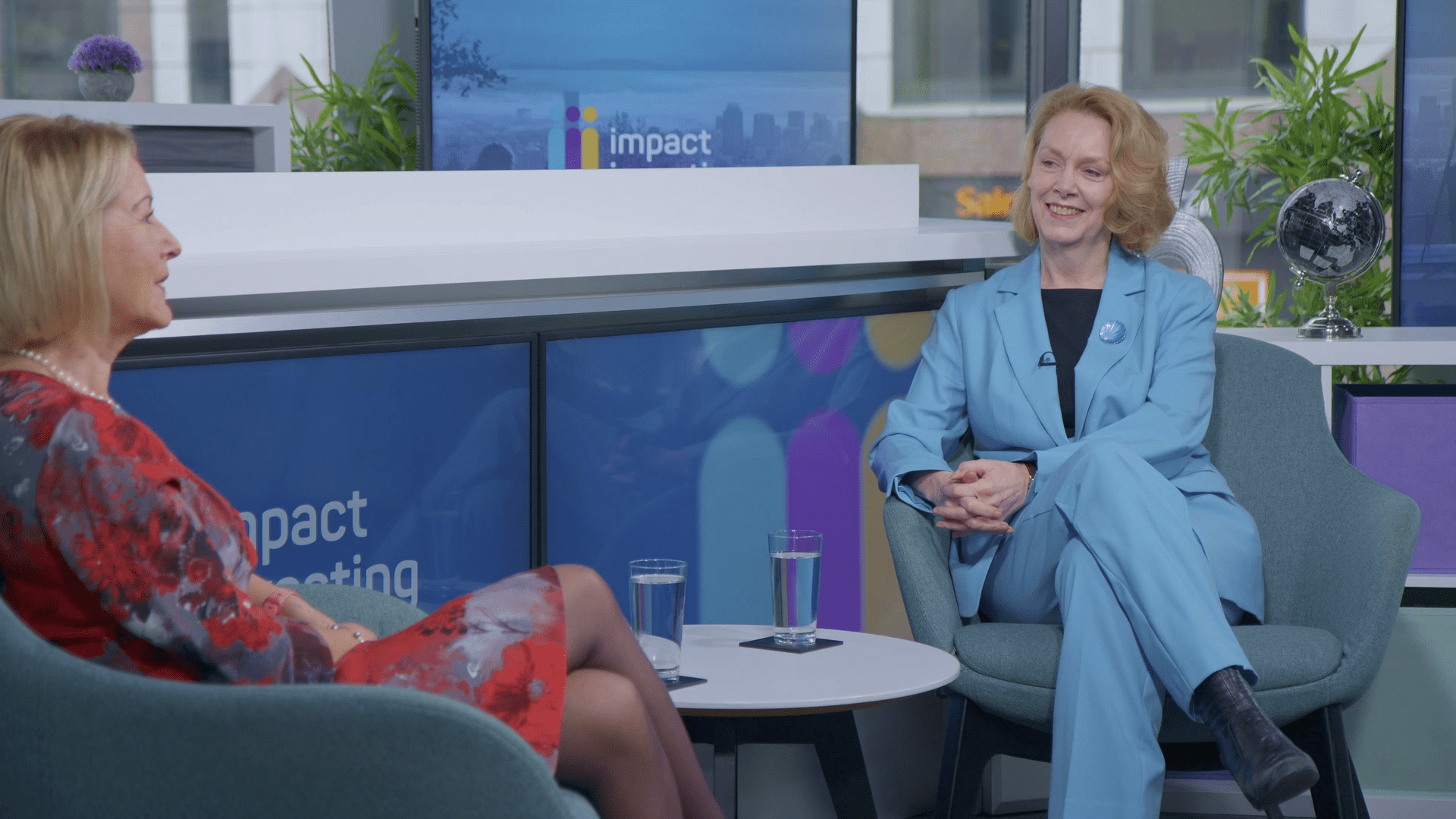

In Conversation with Dame Elizabeth Corley and Helen Dean, CEO of Nest

Category: NewsRead more about this: In Conversation with Dame Elizabeth Corley and Helen Dean, CEO of NestIn this episode of our In Conversation series, our Chair, Dame Elizabeth Corley, spoke to Helen Dean, CEO of Nest, one of the largest UK pension schemes.

-

Fiduciary duty: shifting the investment paradigm

Category: NewsRead more about this: Fiduciary duty: shifting the investment paradigmWhat is the purpose of money? It powers businesses, infrastructure, and governments that ultimately shape the world around us now and for future generations. That probably sounds obvious, but it isn’t always front-and-centre of how most of those managing money make their investment decisions.

-

New work programme funded by Sorenson Impact Foundation

Category: NewsRead more about this: New work programme funded by Sorenson Impact FoundationWe are excited to announce that we will be working on a new programme, funded by the Sorenson Impact Foundation, to identify factors slowing decision-makers within capital markets, as well as policymakers and media professionals, from embracing impact investing to its full potential.

-

FCA launches the UK’s first regulated impact investing label

Category: NewsRead more about this: FCA launches the UK’s first regulated impact investing labelMarking a groundbreaking milestone for the sustainability and impact investing market, the FCA published their brand-new Sustainability Disclosure Requirements, which includes the UK’s first regulated impact finance label.

-

In Conversation with Dame Elizabeth Corley and Rebecca Lewis

Category: NewsRead more about this: In Conversation with Dame Elizabeth Corley and Rebecca LewisIn this new format of our In Conversation series, our Chair, Dame Elizabeth Corley, spoke to Rebecca Lewis, Co-CEO of Arisaig Partners, an investment firm specialising in emerging and frontier markets since 1996.

-

Request for proposals: Data aggregation solution for the CDFI sector

Category: NewsRead more about this: Request for proposals: Data aggregation solution for the CDFI sectorWe are looking for a research partner to help us to find a data aggregation solution for the CDFI sector.

-

Launching our Just Transition Criteria – a new practical investor tool

Read more about this: Launching our Just Transition Criteria – a new practical investor toolBacked by 21 global financial institutions, the Impact Investing Institute launches ‘first of its kind’ practical tool for fund managers who want to invest in a transition to a net zero world that prioritises the needs of the planet and the people living on it.

-

In Conversation with Dame Elizabeth Corley and Nick Ring

Category: NewsRead more about this: In Conversation with Dame Elizabeth Corley and Nick RingIn this episode of our In Conversation series, our Chair, Dame Elizabeth Corley, spoke to Nick Ring, Chief Executive Officer, EMEA of Columbia Threadneedle Investments to discuss their pioneering work in launching the UK’s first Social Bond Fund in 2014, their journey to develop the social investment market and champion impact investing, and the company’s…